How to Build a Partner Strategy That Scales: A Practical Playbook

Expert advice from Franz-Josef Schrepf (Head Partnerships, OpusClips) and Will Taylor (Founder, AudienceLed).

Snapshot

Defining which partnership types to pursue, how leads are qualified and routed, who owns enablement, and which KPIs prove success are the key elements to any program. Without clearly defining and communicating these, you risk wasting engineering, sales, and operations time, creating internal conflict, and eroding customer experience. This article is designed to help you understand how to define and communicates these, so your partner strategy that aligns with your revenue teams.

Strategy without tactics is the slow way to victory, but tactics without strategy are the noise before defeat. -Franz Schrepp

Table of Contents

- Why partnerships matter now

- Start small: test, iterate, scale

- Five partnership types and the partnerships pyramid

- How to work with agencies: a channel playbook

- Managing inbound and avoiding distraction

- Clearing confusion: swim lanes and rules of engagement

- Operations, PRM, and when to invest in tooling

- Common partnership pitfalls and how to avoid them

- KPIs and aligning OKRs across teams

- A checklist to launch your first partner program

- Practical scripts and templates

- When to consider acquisitions and alliances

- FAQs

- Conclusion

Start small: test, iterate, scale

When you are building a partner program, your instinct might be to standardize everything at launch: complex contracts, full PRM implementation, partner tiers, and incentive plans. Resist that. Start with a narrow, high-impact pilot and iterate.

- Pick a small cohort: start with 5 to 10 partners who are already inbound and enthusiastic.

- Design a minimal enablement package: one training session, a concise playbook, starter collateral, and a single point of contact on your team.

- Track early wins and the pain points that arise in a spreadsheet or simple CRM fields.

- Iterate quickly. If a partner creates friction or a bad outcome, you can clean it up without rewriting dozens of agreements.

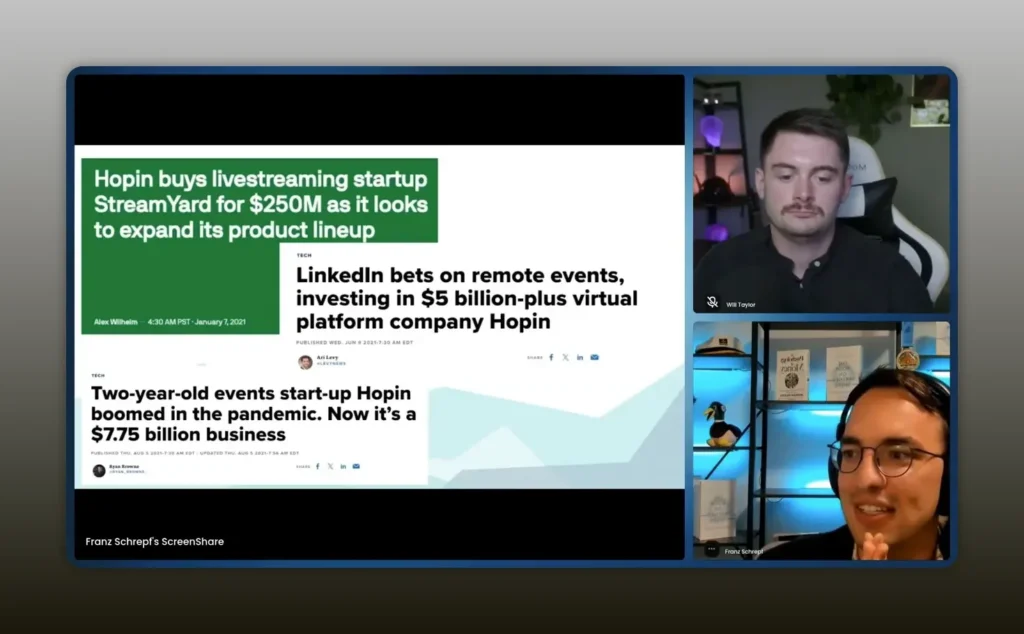

Franz Schrepp’s early experience shows why this matters: starting with 10 agencies allowed Hopin to iterate fast and avoid the blowups that come with scaling prematurely.

Five partnership types and the partnerships pyramid

Partnerships are not a single, monolithic thing. Treating them that way turns the role into a dumping ground for every inbound request. Instead, break partnerships into categories and map each category to the team that will own the outcomes.

Partnerships are not a department. Partnerships are a strategy for every department. -Franz Schrepp

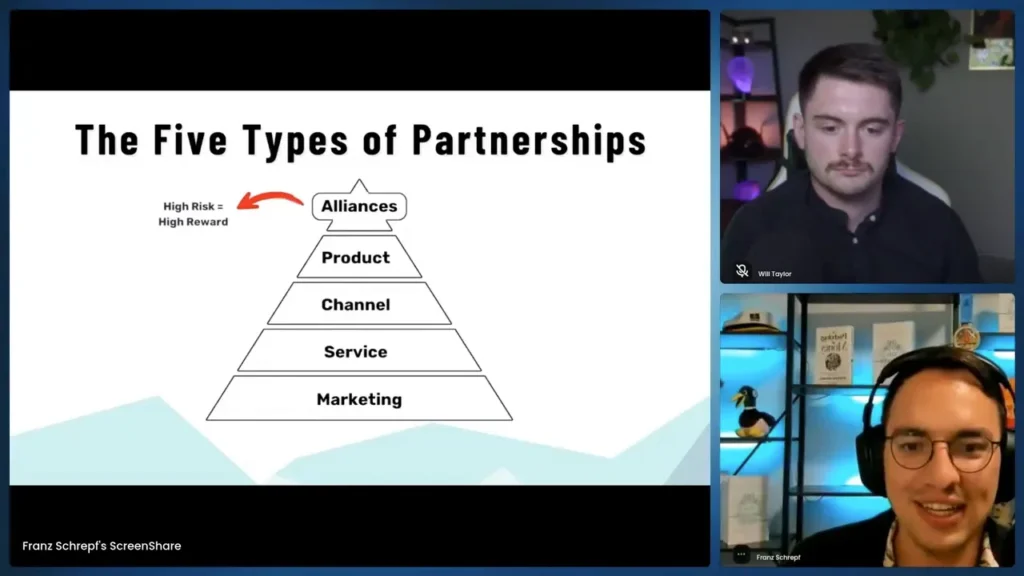

Use a pyramid to visualize the five types of partnerships, ranked by complexity and the resources they require:

- Marketing partnerships — easiest to set up; many can exist simultaneously; good for awareness and demand gen.

- Referral partnerships — partners send leads in exchange for referral fees; relatively low effort but must make business sense for the partner.

- Service partnerships — partners implement or manage services for customers; require enablement but reduce support burden for you.

- Channel partnerships — partners resell or co-sell; need clear pricing, training, and rules of engagement.

- Alliance partnerships — deep integrations and strategic relationships with a few large players; extremely resource-intensive but can unlock major distribution or product capabilities.

Each level maps to different teams and OKRs: marketing partnerships feed marketing goals; channel partnerships must align their goals with sales; service partnerships should be evaluated against customer success metrics; alliance partnerships typically involve product, engineering, and executive stakeholders.

How to work with agencies: a channel playbook

Agencies can be your first scalable channel. They already have a book of clients, domain expertise, and a service business model that aligns well with SaaS. Here’s how to make agencies work for you.

- Find the right agencies — prioritize inbound agencies who already asked for access. Look for credible portfolios and client lists that match your ICP.

- Enable them fast — short, practical trainings; onboarding playbook; sample proposals; pricing guidelines.

- Give them a single thread — rather than managing dozens of one-off deals, keep one channel relationship thread with a partner that aggregates opportunities.

- Protect the customer — ensure your brand experience is maintained; provide clear service level expectations and escalation paths.

- Measure and reward — track closed deals, deal size, and recurring revenue tied to agency activity. Align incentives to recurring ARR rather than one-time services where possible.

One or two days after enabling these agencies, we’re just converting their entire books of business into virtual events customers. -Franz Schrepp

That example demonstrates the multiplier effect of agencies: once trained and enabled, agencies can bring multiple, sizeable deals to the table very quickly.

Managing inbound and avoiding distraction

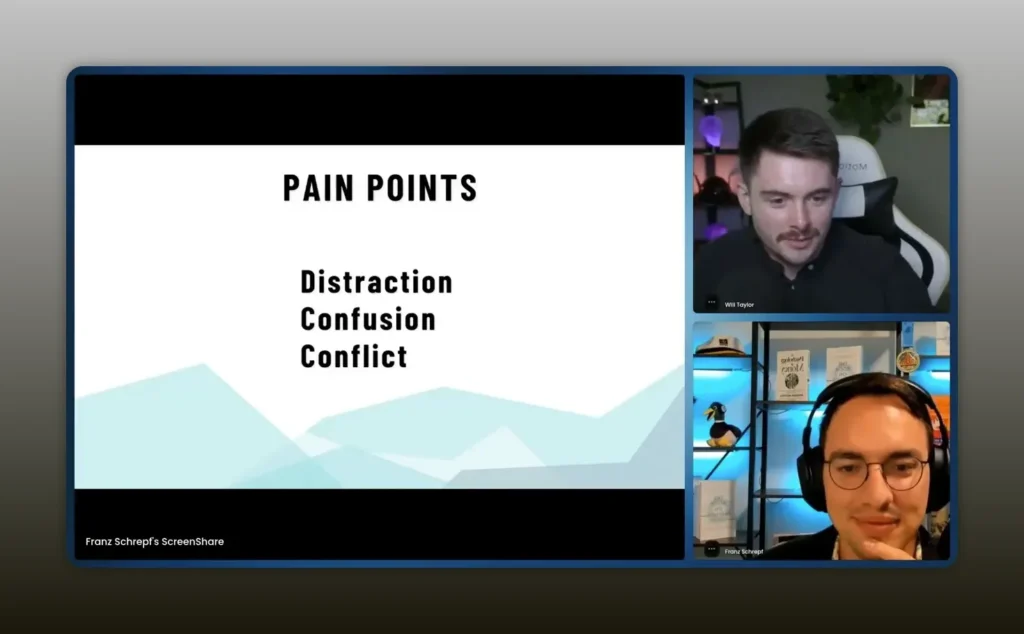

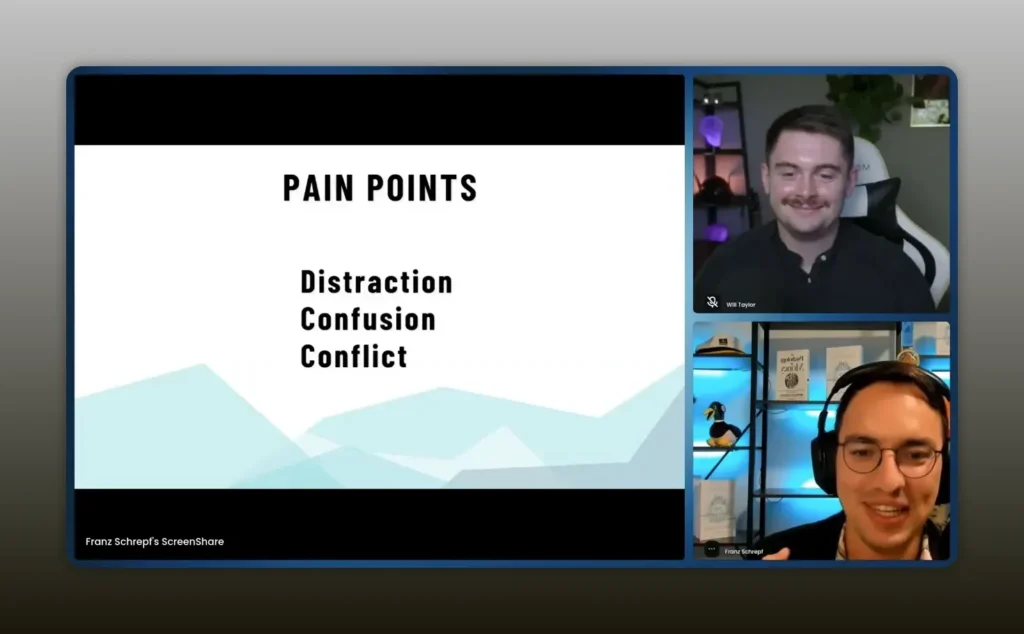

As the partnerships lead, your inbox will become the company’s “other” inbox. People will route everything with the word partnership to you. The key is to triage effectively and to define what counts as a partnership.

- Define your filter — create a simple decision tree to separate partnership prospects from other inbound requests (e.g., is this a potential revenue-generating partnership or a customer asking for a discount?).

- Use a lightweight intake form — capture company size, geography, partnership intent, and potential customer overlap so you can make quick qualification decisions.

- Assign a funnel owner — a single person or rotation that handles new partner leads and applies the decision tree consistently.

- Document exceptions — track edge cases to refine your rules and to justify investments in tooling later.

Franz explained that a big challenge was simply getting through the volume of inbound and finding the strategic opportunities — the “stream yards” — that mattered most.

Clearing confusion: swim lanes and rules of engagement

Conflict between your direct sales team and partners is often the result of unclear swim lanes and misaligned incentives. Use explicit rules of engagement to remove ambiguity.

- Define swim lanes — determine which deals are owned by direct sales and which are owned by partners. Swim lanes can be based on geography, deal size, customer type, or industry.

- Set lead routing rules — if a partner introduces a lead, guarantee that they get credit if it closes within a reasonable time window.

- Design compensation alignment — match channel KPIs to sales KPIs for shared goals. For example, give partners access to leads and set revenue targets that mirror sales quotas.

- Communicate swim lanes across the company — every SDR, AE, and CS rep should know when to hand off to partners and when to compete.

Nelson Wang’s partner swim lanes concept is a helpful model: break up ownership by geography or customer segment so both direct and partner teams have clear territories.

Operations, PRM, and when to invest in tooling

Operations and tooling are critical, but they should be funded by demonstrated need. Don’t ask RevOps to build a complex partner stack until you have proof that partners will generate consistent revenue and operational load.

- Prove product-market fit for partnerships manually — run a pilot and capture revenue and operational pain points in simple tracking sheets.

- Quantify the pain — show ops how many deals partners are closing, how many handoffs you manage, and the time spent on partner support.

- Prioritize tooling by function — start with lead routing and attribution, then invest in partner enablement and PRM as the number of partners and deal complexity grows.

- Choose tools that support the partnership type — marketing partners need co-marketing and tracking; channel partners need lead distribution, deal registration, and revenue attribution; service partners need onboarding and ticket triage systems.

It was much easier to get ops bought in once we had like a lot of deals coming through and a lot of revenue being generated. -Franz Schrepp

Ops will move when you show them that the investment reduces toil and materially impacts revenue. Use that story to get the right systems in place at the right time.

Common partnership pitfalls and how to avoid them

Many problems are preventable with a few crisp guardrails.

- Bad actors and bait-and-switch partners — perform quick reference checks; protect your brand with clear contractual terms; include termination clauses for violations.

- Exclusive demands from partners — don’t give exclusivity early. If exclusivity is required, demand performance-based milestones to keep the arrangement fair.

- Discount-only “partnerships” — if a request for partnership is really a disguised discount ask, treat it as a commercial negotiation rather than a strategic partnership.

- Competing internal incentives — align partner KPIs with the teams they support to avoid internal competition.

- Over-commitment of internal resources — reserve partnerships that need heavy engineering or product work for the alliance level, and evaluate ROI carefully.

They created a competitive platform, sold Hopin, then switched customers to their copycat. -Franz Schrepp

That example highlights the need for early diligence and quick remediation processes. When a partner violates trust, you must act decisively to protect customers and the brand.

KPIs and aligning OKRs across teams

Measure what matters. The correct KPIs vary by partnership type, but each partner program must have clear, measurable objectives that tie back to the teams you are supporting.

- Marketing partnerships — tracking: reach, MQLs generated, conversion rate.

- Referral partnerships — tracking: referrals sent, conversion rate, ARR per referral.

- Service partnerships — tracking: customers onboarded, CSAT, renewal rates.

- Channel partnerships — tracking: pipeline sourced, deals closed, ARR, deal registration effectiveness.

- Alliance partnerships — tracking: strategic deal wins, integration adoption, co-investment ROI.

At Hopin, Franz aligned channel OKRs to sales OKRs so that agencies had a clear revenue target and shared incentives with the sales organization. That alignment reduces friction and creates a shared definition of success.

A checklist to launch your first partner program

- Identify the partner type you are testing (agency, referral, marketing, channel, alliance).

- Select 5 to 10 pilot partners that fit your ideal profile and are already inbound if possible.

- Create a short enablement package: training, one-pager, sample proposal, service templates.

- Define a simple lead intake form and qualification criteria for partners.

- Set clear swim lanes and rules of engagement between sales and partners.

- Agree on KPIs and reporting cadence; align partner OKRs with the supporting internal team.

- Instrument deal tracking so you can attribute revenue and time-to-value.

- Document common partner failure modes and remediation steps.

- Iterate weekly for the first month and adapt onboarding materials based on partner feedback.

- When revenue and operational load justify tooling, prioritize lead routing/attribution systems and a PRM.

We figured out this unlock where we don’t need to hire as much — agencies sold and serviced for us. -Franz Schrepp

Follow the checklist above to avoid common traps and to scale intentionally.

Practical scripts and templates

Here are short, practical templates to use in the first 30 days.

- Intro outreach to an agency — “Hi, we see you work with X customers. We have a virtual events solution that many of your clients would benefit from. Can we set a 30-minute demo and talk about how to co-sell?”

- Enablement email — “Welcome to the partner program. Attached is the 20-minute training deck, a one-page pricing guide, sample proposal, and a checklist for onboarding your first client.”

- Deal registration form — “Customer name, ICP tier, expected ARR, close timeline, partner rep, any existing relationship with internal sales.” Use this to protect partner-introduced opportunities.

- Escalation for service issues — “If the partner cannot deliver within SLA, escalate to partner success at [email]. We’ll triage within 24 hours.”

When to consider acquisitions and alliances

Partnerships can evolve into deeper strategic relationships or acquisitions. A few indicators that an alliance or acquisition could make sense:

- Product overlap where integration unlocks meaningful customer value.

- Partners that consistently bring high-quality leads and require close engineering collaboration.

- Opportunities to accelerate a product roadmap via co-development rather than building in-house.

We acquired StreamYard for $250 million — it started out as a product partnership. -Franz Schrepp

Strategic relationships can become acquisitions if they materially change your product-market fit or shorten the path to valuable features. Treat this as a long-term strategic decision and ensure the due diligence includes partner behavior patterns and customer outcomes.

FAQs

How do I start a partner program with limited resources?

Begin with a narrow pilot: recruit 5 to 10 inbound partners, enable them with a minimal playbook, and track results manually. Use early wins to get ops buy-in before investing in PRM or complex tooling.

What metrics should I track for channel partners?

Track pipeline sourced, deals closed, ARR, average deal size, time to close for partner-sourced deals, and partner churn. Align partner KPIs with the internal team’s OKRs to reduce friction.

How do I prevent conflict between direct sales and partners?

Define clear swim lanes based on geography, deal size, industry, or other logical segmentation. Implement deal registration, set lead routing rules, and align compensation so both parties share incentives for long-term ARR.

When should I invest in partner management tooling?

Invest when you can show consistent partner-sourced revenue and operational burden. Start with tools for lead routing and attribution first, then expand to PRM for enablement and performance monitoring.

What do I do about partners who ask for exclusivity or special pricing?

Be cautious. Do not grant exclusivity without performance clauses and timelines. If a partner requests special pricing, treat it as a commercial negotiation; ensure that discounted pricing won’t create channel conflict or erode your margins.

How can I detect a bad-acting partner early?

Monitor the first few deals closely, get direct feedback from customers, and check for patterns like unexplained platform switches or sudden drop-offs in delivery quality. Include termination clauses for brand abuse in partner agreements.

Conclusion

Partnerships can be a powerful multiplier when you design a simple, aligned, and modular strategy. Start small, choose the right partner types for your stage, and map each partnership category to the internal team it supports. Use clear swim lanes and measurable KPIs to avoid conflict, and only invest in heavy tooling when you have proof of consistent partner value. The approach that worked at scale for Franz Schrepp and the teams he led was practical: pilot, measure, align, and then scale. If you keep those principles front and center, you will be able to convert inbound chaos into sustainable growth without breaking the organization.