Why Partners Matter Now: Navigating Generative AI, Marketplaces, and the New Buyer

Expert advice from Jay McBain (Analyst, Canalys) and Justin Zimmerman

Snapshot

Your mandate: Distribution, technology, and buyer behavior have converged to rewrite how value is created and captured. What is at stake is not just revenue growth but the very survival of companies that have relied on old models of selling, packaging, and supporting technology.

When distribution shifts, fortunes shift with it: shelf space, deal flow, and customer attention migrate to the channels that make buying frictionless and outcomes measurable. When the topology of computing moves edge to cloud and AI becomes an embedded capability rather than a standalone SKU, the organizations that own customer relationships, stitch systems together, and operate solutions at scale will define winners and losers. This moment combines generative AI, metered consumption, and rapidly maturing marketplaces with a new generation of digital-first buyers who favor best-of-breed, integration-first stacks.

The practical implication is clear — you must redesign partner programs, publish hybrid reference architectures, align with FinOps and ops teams, and fund partner-led post‑sale activities if they want to remain relevant. This article will help move forward on these opportunities.

I track these things because the channel is the backbone of global trade — if you don’t get partners right, you don’t get to play in the next economy. – Jay McBain

Table of Contents

- The numbers that frame the opportunity

- Why channels matter more than ever

- Three eras of compute and the new 20-year cycle

- Generative AI: a partner-first revolution

- Edge-first computing and where partners add value

- Marketplaces, private offers, and the new commerce model

- The seven-layer stack and the new buyer

- Partners are no longer pigeonholed

- How partner programs must change

- The new center of gravity: FinOps and cross-functional ops

- What successful partner strategies look like in practice

- Checklist: 12 actions to prepare your partner ecosystem

- FAQs

- Conclusion

The numbers that frame the opportunity

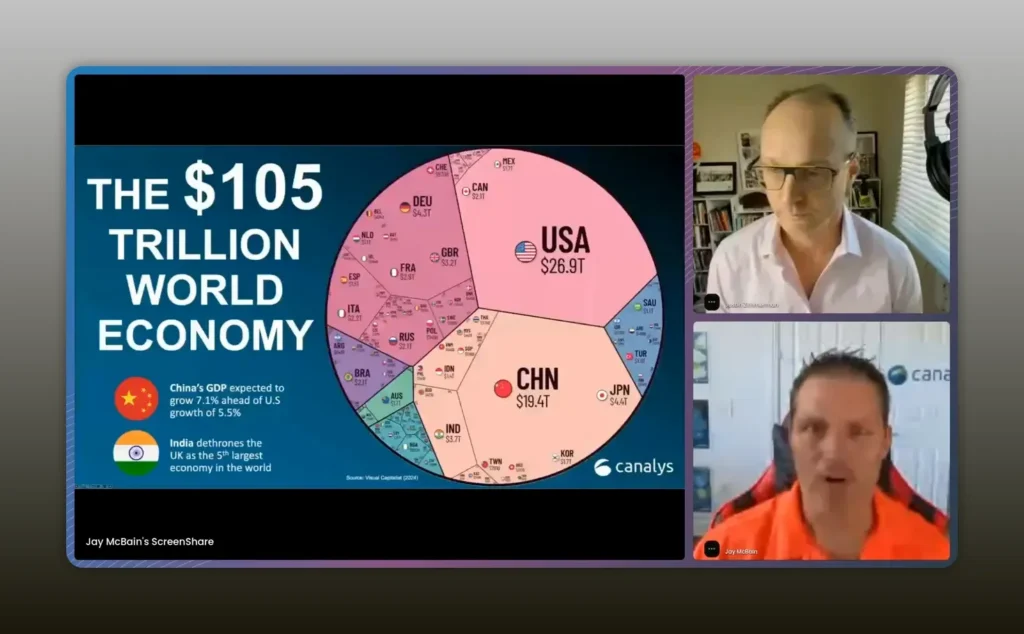

Start with the scale. Global GDP sits above one hundred trillion dollars, and much of commerce flows indirectly through channels. Within technology and telecom, the addressable market is massive: in 2025, spending across hardware, software, and services is estimated to be roughly $5.4 trillion — approximately a trillion for hardware, a trillion for software, and about $3 trillion for services.

75% of world trade flows indirectly; that statistic alone makes channels a strategic priority, not a line item. – Jay McBain

Those figures are not abstract. They underpin critical business outcomes. When distribution mismatches the customer’s buying patterns, even iconic brands suffer. A household name can face bankruptcy or sudden valuation loss not because of product quality but because the distribution model fails to meet where customers expect to buy.

Why channels matter more than ever

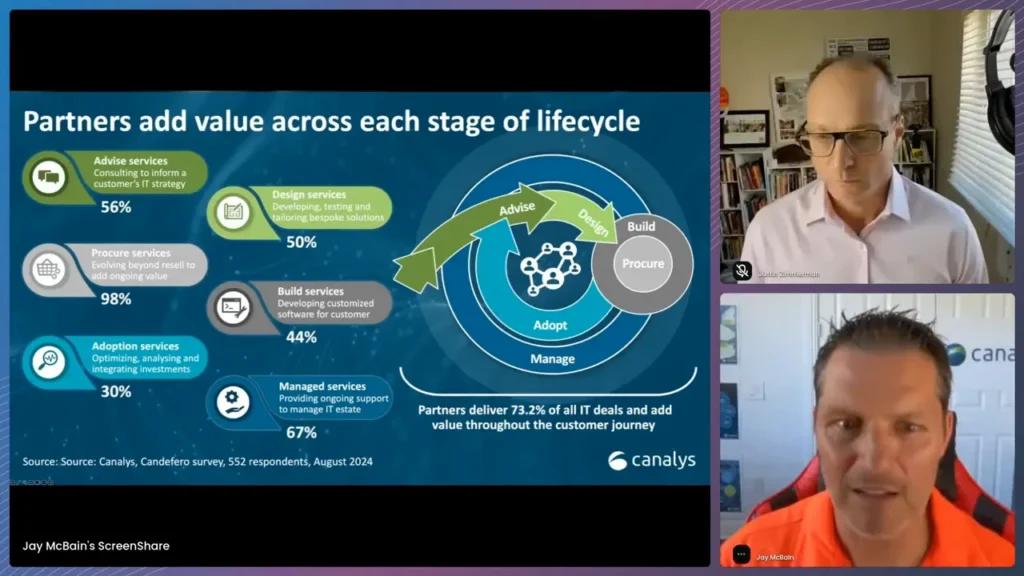

Channels are not a legacy cost. They are the mechanism by which buyers discover, trust, configure, implement, and maintain solutions. Jay McBain frames this plainly: 73.2 percent of the industry’s deliveries happen through partners. Put another way, nearly three-quarters of technology sales are realized with partners in the loop.

That reality shows up in corporate performance. Sales teams that consistently hit objectives point to partners as the differentiator. When Microsoft talks about “partner assist” and measures partners in 96 percent of deals, they are describing the modern reality: partners amplify reach, specialize integration, and turn product features into business outcomes.

Three eras of compute and the new 20-year cycle

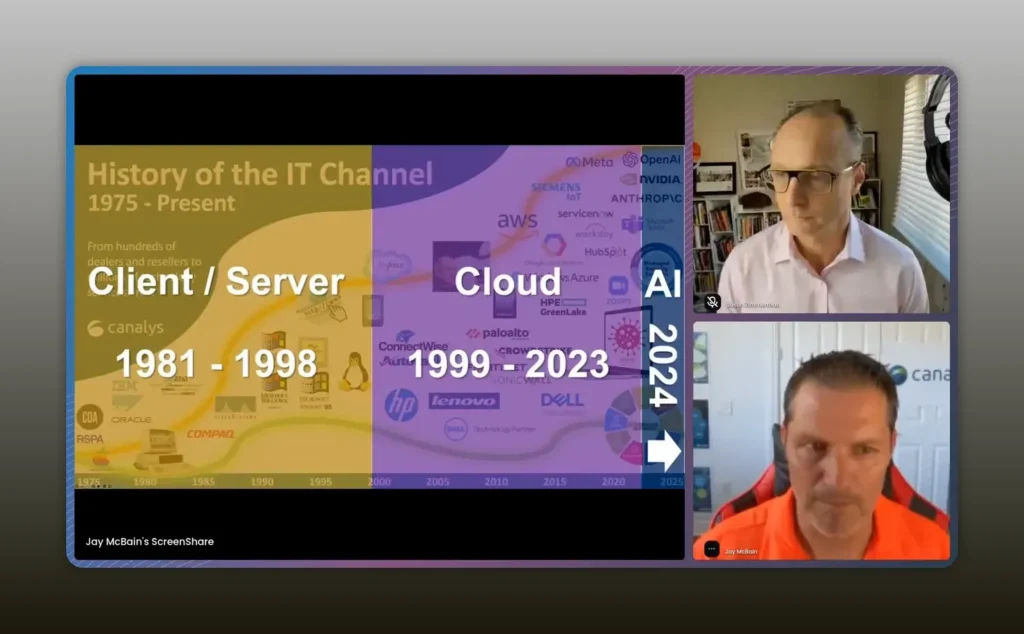

The history of technology distribution can be understood as a sequence of roughly two-decade eras. The client-server era took off after the IBM PC changed the landscape in 1981. Later, SaaS companies rewrote enterprise software delivery. Then hyperscalers — AWS, Google, Microsoft — reshaped compute and distribution. Each era changed who the buyer is and how products are consumed.

Now, you are in the opening of a new 20‑year cycle driven by generative AI and an edge-to-cloud topology. This is not a small shift. It is a re-architecting of where workloads live, how data is used, and where the value gets captured. The companies that learn to coordinate across this new topology will harvest the rewards.

Generative AI is a generational partner opportunity — every partner type has a role to play in turning models into business cases. – Jay McBain

Generative AI: a partner-first revolution

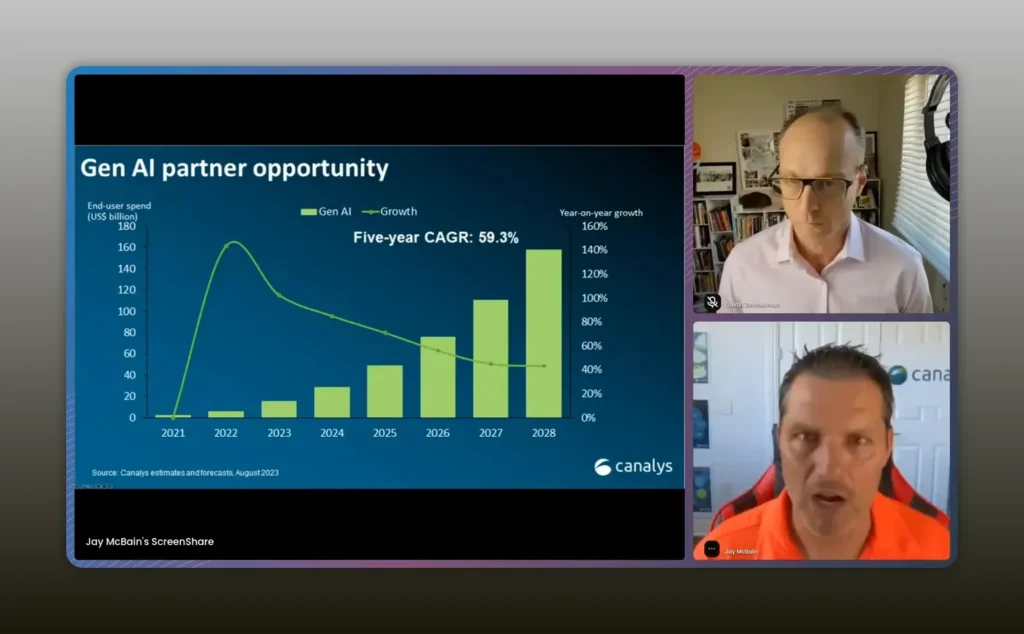

The hype of generative AI produced spectacular consumer moments within two years: poetry, images, music, even deepfakes that made the public sit up and ask what is coming. Early results are underwhelming relative to the hype — large consulting and systems integrators reported flat results — but the long-term expectation is seismic.

You need to think in decades, not quarters. Generative AI is expected to drive large compound growth across services, ISVs, and platform partners. Forecasts that look at the partner ecosystem — figures quoted by major vendors as multi-trillion dollar opportunities — are meaningful because the partner layer is where models meet enterprise processes and data.

We are underestimating the 10-year impact. Right now it feels noisy, but the multiplier for partners will be immense. – Jay McBain

AI is not a product you package separately

One of the most important shifts is the realization that AI is not a standalone SKU. It is an embedded feature set. Every ISV becomes a software-and-AI company. That means partners that can embed AI into workflows, integrate across systems, and operationalize models will be the ones customers rely on.

Edge-first computing and where partners add value

Most enterprise business data remains on premises or at the edge — estimates suggest over 80 percent. That data sits with banks, governments, airlines, and other organizations that will not, and often cannot, wholesale migrate everything to public clouds. The result is a topology where compute, inference, and data orchestration live across edge, on-prem, and cloud.

This topology plays to partners’ strengths. Partners are experts at architecture, systems integration, and local infrastructure. They design hybrid solutions, secure data flows, and operate managed services near the customer. The edge is where partners do their best work.

Most of the work in the next eight years will be done at the edge — that is precisely where partners excel. – Jay McBain

What partners will be doing at the edge

- Consulting and solution design for hybrid AI systems

- Data modernization, ETL, and governance from legacy systems

- Edge deployment, device management, and inference optimization

- Managed services for model lifecycle, observability, and compliance

- Integration of AI into existing business processes and third-party platforms

Combine these capabilities and you see how a partner can turn a generic model into a business-specific, compliant, and measurable outcome. That is real commercial value.

Marketplaces, private offers, and the new commerce model

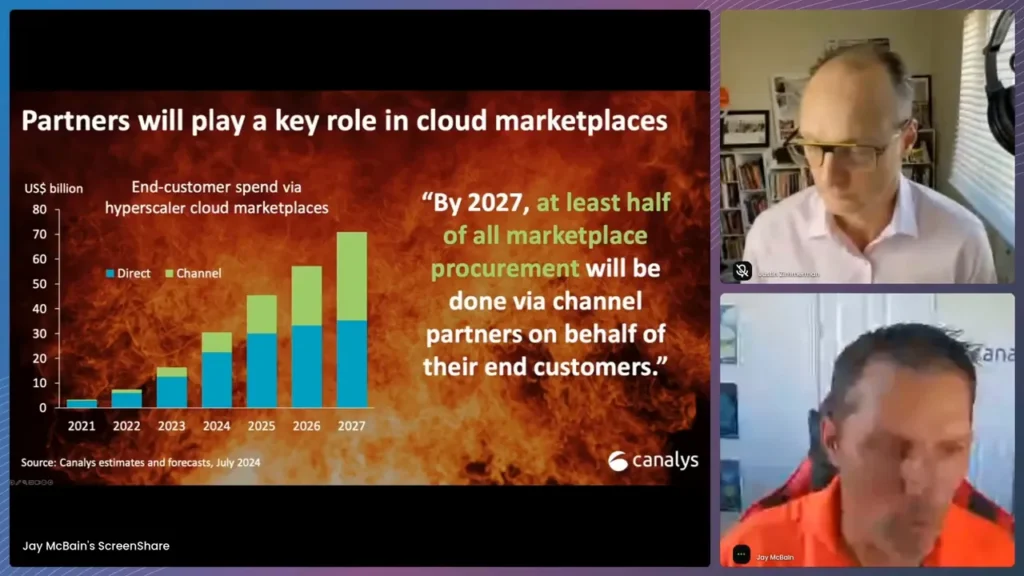

Marketplaces are the orchestration layer for the new economy. Five years ago a prediction was made that cloud marketplaces would grow at compound rates in the 80s, and that they would become major distribution channels. That forecast is playing out: marketplaces are expanding fast and are now measured in tens of billions of dollars of annual revenue, with large upside.

Marketplaces are not a fad; they are becoming the primary way many customers transact for technology and services. – Jay McBain

Two related changes matter for you:

- Marketplaces are moving beyond one-vendor listings to private offers, multi-partner bundles, and distributor-enabled sellers. By 2027, expect many marketplace transactions to include explicit partner participation or multi-party offers.

- Building a competitive marketplace is capital intensive. The barrier to entry is high — only a few distributors and hyperscalers have the cash flow to compete with leaders like AWS or Microsoft.

For you this means marketplaces will be important, but not all marketplaces are equal. Choose the marketplaces where your partners can be discovered, funded, and rewarded.

The seven-layer stack and the new buyer

A crucial point Jay McBain makes is that the buyer has changed. The majority buyer is now digital-first, born after 1982, and comfortable composing a seven-layer best-of-breed stack rather than buying monolithic systems. They trust multiple partners, expect subscription and consumption pricing, and rank integration and interoperability above traditional buying criteria like brand or single vendor support.

The new buyer purchases a seven-layer stack of best-of-breed; integration and partner orchestration now lead the buying criteria. – Jay McBain

For you, that shifts two imperatives:

- Design products and offers that are integratable and partner-friendly by default.

- Support partner-led implementations and co-sell/co-market engagement models to reach more customers where they prefer to buy.

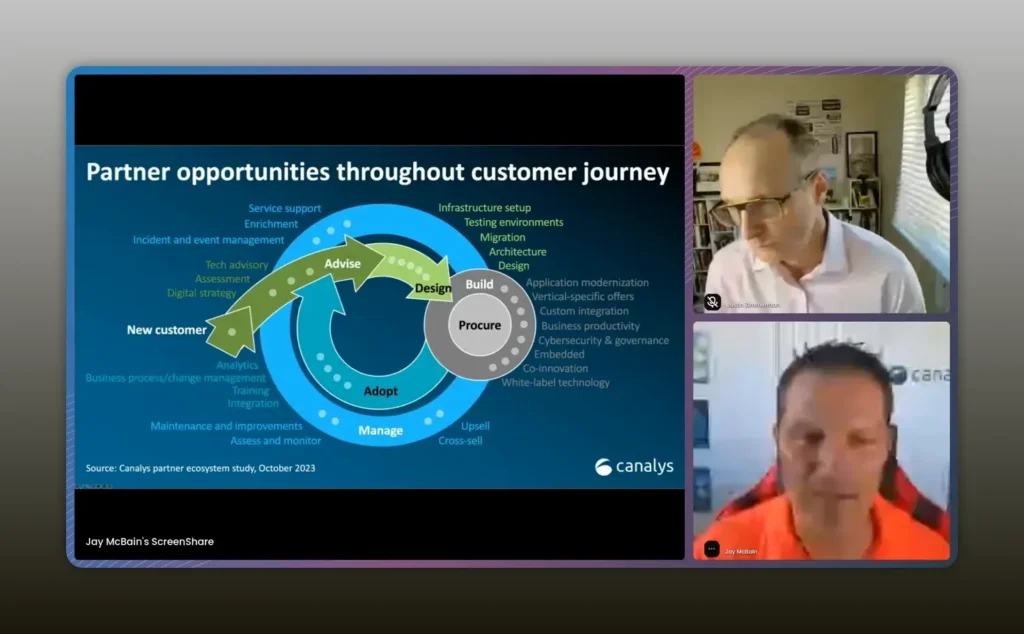

Partners are no longer pigeonholed

The old taxonomy — VARs, SIs, MSPs, digital agencies — is collapsing. Partners now do an average of 3.2 activities. The same firm may consult in the morning, resell in the afternoon, provide managed services next week, and ship code from its engineering team the month after.

If you try to typecast a partner, you’ll miss the reality: partners now wear multiple hats and expect to be measured and rewarded for the full spectrum of work. – Jay McBain

That has implications for how you architect partner programs and incentives. A single partner can deliver services, software, and ongoing operational value — your program must recognize and reward that continuum.

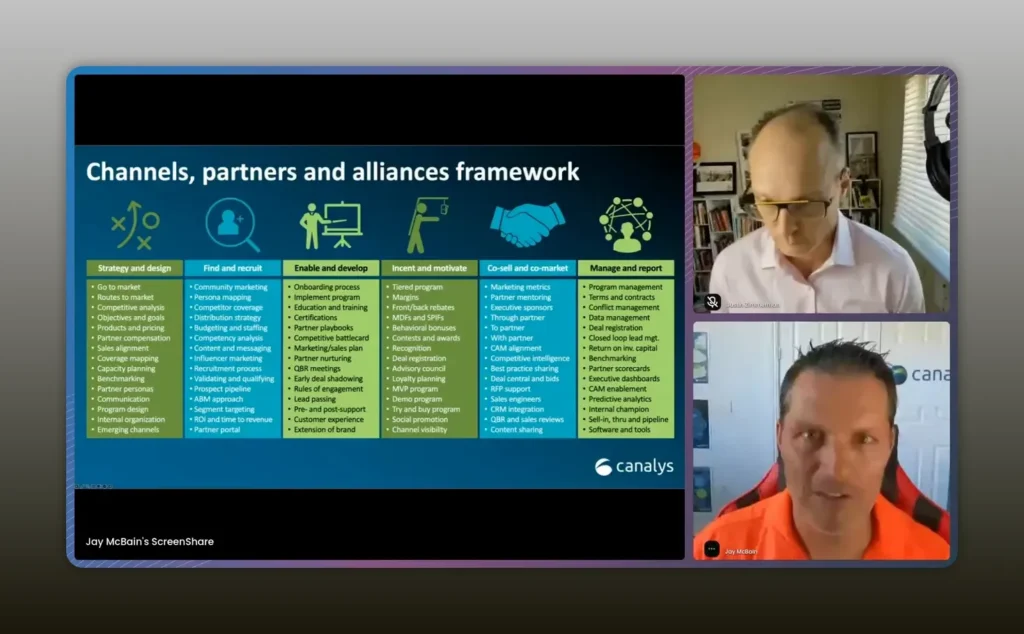

How partner programs must change

Legacy channel programs were linear checklists: deal registration, tiered competencies, partner portals, and rebate calculations. The modern partner program is more dynamic and outcome-oriented:

- Measure partner value across the customer lifecycle, not just at point of sale.

- Allocate funding to post-sale activities and services where most revenue accrues.

- Support multi-partner collaborations and private offers on marketplaces with flexible revenue share.

- Provide enablement for integration, co-development, and managed operations.

Large vendors have already shifted. Microsoft adopted a point system that places a sizable portion of partner rewards on post-sale activities. Cisco has moved toward recurring revenue models and is aligning partner incentives to ongoing customer outcomes. Your partners now ask for recognition as builders and operators, not mere transaction conduits.

Recognize partners as builders and operators. Make post-sale rewards central to your program design. – Jay McBain

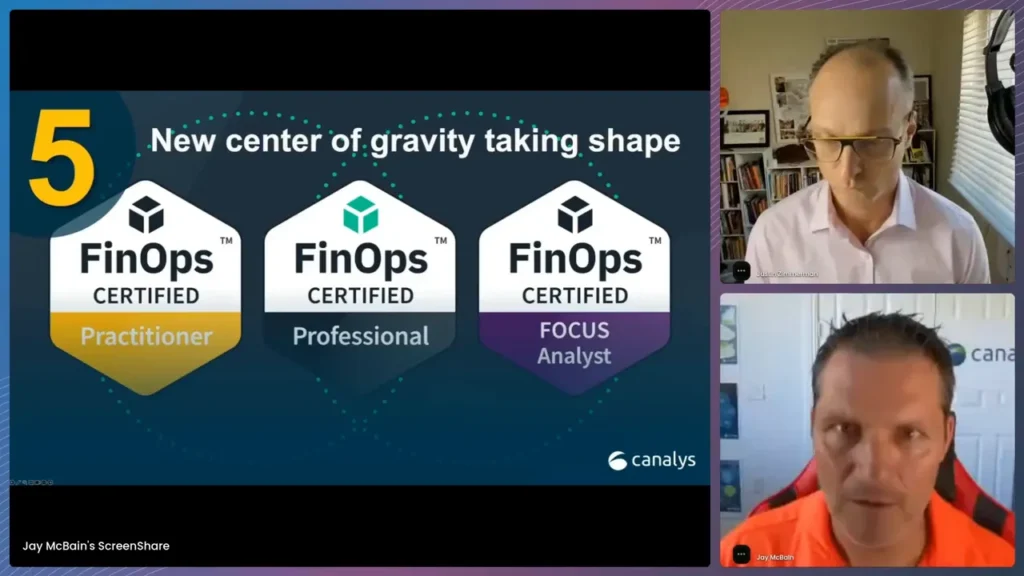

The new center of gravity: FinOps and cross-functional ops

One insight that often gets overlooked is the rise of FinOps and allied operational roles. FinOps emerged as a discipline sitting between CFO and CIO, charged with optimizing cloud and consumption costs. As generative AI introduces new pricing models — metered inference, per-agent charges, per-chat bursts — the role of those who merge finance and technical understanding becomes pivotal.

These professionals decide where workloads run, how to de-risk vendor spend, and how to structure procurement that mixes cloud, on-prem, and edge. They will influence vendor choice, partner selection, and the economics of long-term engagements.

FinOps and related ops teams will hold the ear of the CFO — they will materially determine which partners and vendors succeed. – Jay McBain

For you, building credibility with FinOps, RevOps, and Channel Ops is as important as winning over engineering. Speak their language: unit economics, marginal cost of inference, meterability, and total cost of ownership over multiple horizons.

What successful partner strategies look like in practice

Practical partner strategies combine program design, marketplace participation, and operational enablement. Here are common elements of successful approaches:

- Outcome-based pricing: Link vendor and partner incentives to customer outcomes, not seat counts.

- Private offers and multi-partner bundles: Enable partners to assemble end-to-end solutions on marketplaces with clear revenue split.

- Post-sale funding: Invest in partners for onboarding, integration, and managed services — the post-sale period often creates 2x–3x service revenue.

- Verticalized enablement: Provide industry-specific playbooks, data schemas, and model tuning guidance for partners to accelerate deployments.

- Edge and hybrid reference architectures: Publish tested architectures for edge inference, data governance, and latency-sensitive apps so partners can implement quickly.

- Integration-first product design: Expose APIs, developer kits, and prebuilt connectors to make partners’ work faster and less risky.

These components align the incentives of vendors, partners, and customers. They reduce friction, make marketplace listings more compelling, and generate repeatable revenue.

Checklist: 12 actions to prepare your partner ecosystem

- Inventory partner capabilities beyond resell: services, IP, cloud ops, software development.

- Shift incentives to reward post-sale activities and recurring revenue generation.

- Build marketplace-ready offers that support private pricing and multi-party bundles.

- Create vertical playbooks that include data requirements, security, and compliance checklists.

- Publish edge-hybrid reference architectures and validated appliance designs.

- Invest in partner enablement: labs, sandboxes, model tuning guides, and certification paths.

- Train sales teams to co-sell and lean on partners as deal accelerators.

- Engage FinOps and procurement early; present unit economics and ROI frameworks.

- Quantify partner-assisted revenue and make it visible in your reporting.

- Support ISV partners to embed AI features without becoming pure platform play.

- Design flexible revenue-sharing that accommodates software, services, and operations.

- Measure partner success by customer lifetime value, renewals, and expansion, not just one-time bookings.

Get the customer to the dance and keep them dancing — partner success is lifecycle success. – Jay McBain

FAQs

How large is the partner opportunity in generative AI?

The partner opportunity spans services, integrations, data modernization, and marketplace commerce. Estimates from leading vendors place the total addressable market in the multi-trillion-dollar range; importantly, services and integration — where partners dominate — make up a substantial portion. Expect high double-digit compound growth for partner-related AI revenue over the next decade.

Why are marketplaces important for partners?

Marketplaces centralize discovery, streamline procurement, and enable private offers and bundled deals. They allow partners to package services and software with vendor products and provide a frictionless buying experience for digital-first buyers. Not all marketplaces will succeed; target those that enable multi-partner offers and provide funding incentives.

What does edge-first topology mean for deployments?

Edge-first topology means that inference and certain data processing happen close to where the data is generated rather than being fully centralized in public clouds. This reduces latency, protects sensitive data, and optimizes costs. Partners will design hybrid architectures that balance on-prem, edge, and cloud resources.

How should partner programs change to stay relevant?

Shift from rigid, tier-based programs to flexible, outcome-oriented systems. Reward post-sale services, provide marketplace-enablement, support co-development, and make it simple for partners to earn recurring revenue. Recognize that partners perform multiple roles and design incentives accordingly.

Who are the new internal stakeholders partners must engage?

Beyond CIOs and procurement, partners must engage FinOps, RevOps, marketing ops, and channel ops. These roles blend technical understanding with financial accountability and will influence where workloads run and which vendors are chosen.

Can small partners compete in this landscape?

Yes. Small partners can win by specializing vertically, embedding unique IP, and partnering with larger distributors or marketplace channels for reach. Success depends on demonstrating measurable outcomes, operational reliability, and the ability to integrate models into customer workflows.

What metrics should you track to measure partner success?

Track partner-influenced ARR, post-sale services revenue, renewal and expansion rates, time-to-value for deployments, and customer satisfaction for partner-delivered solutions. Also measure marketplace conversion rates for partner offers and the unit economics of metered AI consumption.

Conclusion

You are entering an era where partners are not optional; they are essential. The convergence of generative AI, edge-first architectures, marketplaces, and a new digital-first buyer demands that you reimagine partner strategy. Design programs that reward lifecycle value, enable marketplace participation, and treat partners as co-creators and co-operators. Invest in FinOps relationships and publish architectures that remove implementation risk. The companies that do this will capture outsized returns in the next two decades. Those that cling to old models will find the marketplace—and the buyer—moving on without them.