List on Cloud Marketplaces Fast: Sugar Console, AWS Updates, and Best Practices

Expert advice from Barbara Treviño (Alliances, Sugar.io) and Justin Zimmerman.

Snapshot

Fact: Appearing in a marketplace puts your product directly into procurement flows, gives buyers familiar billing and compliance modalities, and short-circuits trust barriers that slow traditional enterprise sales. The faster you move from idea to active listing, the sooner you begin capturing not only transactions but invaluable behavioral signals—what packaging converts, which pricing tiers customers choose, and which features drive adoption.

However, getting listed is not a tactical checkbox. It reshapes product roadmaps, forces clarity around pricing and telemetry, and touches finance, legal, sales operations, partnerships, and customer success in equal measure.

Moving quickly requires cross-functional coordination—clear roles, simple workflows, and the right integrations—so you can iterate on listings and pricing without dragging weeks of overhead into every experiment. The rest of this article unpacks what to prioritize, where to automate, and when to partner so you can convert speed into sustainable growth rather than accidental complexity.

Marketplaces are easy for the buyer, but not for the seller. Understanding the hyperscaler ecosystem and operationalizing it across your company is the real challenge. — Barbara Treviño

Table of Contents

- Why speed to market matters

- Key AWS re:Invent updates that change the game

- Buy versus build: the decision framework

- What Sugar does and why it matters

- Walkthrough: Sugar Console and core capabilities

- AI autofill: create listings in minutes

- Offer management, entitlements, and renewals

- Usage metering and consumption-based billing

- Analytics and partner attribution

- Workflows and integrations: gluing the org together

- How to plan a fast marketplace launch

- Checklist for marketplace readiness

- Common gotchas and how to avoid them

- When Sugar is the right move

- Examples and brief case notes

- How to measure success

- Practical next steps

- FAQs

- Conclusion

Why speed to market matters

Time is money. That is not a slogan, it is a commercial truth. The earlier you appear in a customer’s procurement path, the greater the chance your product is selected. When you show up in a cloud marketplace, you are often invited into procurement conversations and enterprise contracts that would otherwise be closed to you. A listing on AWS Marketplace, Azure Marketplace, or Google Cloud Marketplace is not just visibility; it is a sales enablement mechanism with billing, procurement, and enterprise trust baked in.

Beyond pure revenue, speed matters for product-market fit. When you can iterate on a listing, pricing, and packaging rapidly you gain data on what enterprises want, which features they adopt, and what drives conversions. If you have a PLG or multi-product strategy, the ability to launch many listings quickly becomes a force multiplier.

Barbara points this out repeatedly: the buyer experience is streamlined, but the seller experience often involves unexpected complexity. You do not want months of internal engineering and process overhead standing between your product and the market.

Key AWS re:Invent updates that change the game

At re:Invent, Amazon announced several marketplace-focused enhancements that reduce friction and open new routes to buyers. Barbara described three that matter most for sellers:

- Partner connections — A way for more than one partner to collaborate on a single opportunity within AWS systems. This is the cloud-native counterpart to joint co-sell objects you might have modeled in Salesforce.

- Buy with AWS button — A purchase CTA you can embed on your own website or landing pages that drives buyers directly into the AWS buying flow, cutting procurement friction.

- AI virtual assistant inside Partner Central — An AI-powered assistant to help partners navigate Partner Central and accelerate marketplace readiness with context-aware answers.

Why these updates matter for you:

- Partner connections reduce administrative overhead for joint deals and create clearer attribution. You can coordinate multi-party offers and keep opportunity-level data consistent.

- The Buy with AWS button converts website traffic into marketplace transactions faster and with fewer steps, which is crucial for driving inbound conversions.

- AI assistance inside Partner Central shrinks ramp time. Instead of digging through docs and portals, your alliance and RevOps teams get immediate answers and guided steps.

Buyers can now interact with this AI chat box and ask questions about accelerating their journey into marketplace. —Barbara Treviño

Buy versus build: the decision framework

Teams frequently default to building a marketplace integration internally. The reasoning is understandable: product or engineering says “we can build that” and everyone assumes it is cheaper or faster. Reality often looks different.

Consider the true set of requirements to list and operate on a hyperscaler marketplace:

- Product integration specifics for marketplace entitlements and metering

- Portal and program requirements from each cloud provider

- Legal and commercial templates for private offers and pricing

- Operational workflows for deal desks, finance, and renewals

- Monitoring and analytics to measure marketplace performance and partner contribution

- Ongoing updates as marketplaces evolve (APIs change, new features roll out, new compliance needs arise)

Barbara’s personal experience is instructive. She built in-house once and found it took over six months of cross-functional effort, diverting engineering, RevOps, deal desk, finance, and executive focus. That time is expensive, and it also set a maintenance burden for future marketplace changes.

When to buy:

- If you lack deep experience with hyperscaler ecosystems and need a faster path to revenue.

- If you want predictable operational support: someone watching the marketplaces and adapting to changes.

- If you plan multiple listings and need automation and scale rather than a one-off engineering effort.

When to consider build:

- If your product has highly unusual technical constraints that a partner cannot meet.

- If you already operate at significant scale on one cloud and internal investment will be amortized across many in-house needs.

What Sugar does and why it matters

Sugar is both a services organization and a software company. The core proposition is straightforward: take the marketplace operational burden off your plate and give you a single pane of glass for listings, offers, entitlements, usage, revenue, and integrations.

Sugar integrates with AWS, Google, and Azure marketplaces and with your internal systems so marketplace is not a siloed alliance or partnerships play but rather a fully operationalized go-to-market channel across the company. For you this means:

- Faster listing creation using automated processes and AI autofill.

- Centralized offer and entitlement management for multi-cloud listings.

- Usage metering to capture consumption revenue for hybrid pricing models.

- Analytics dashboards to measure transactions, product performance, and partner attribution.

- Workflow automation to integrate marketplace events into deal desk, finance, and renewals processes.

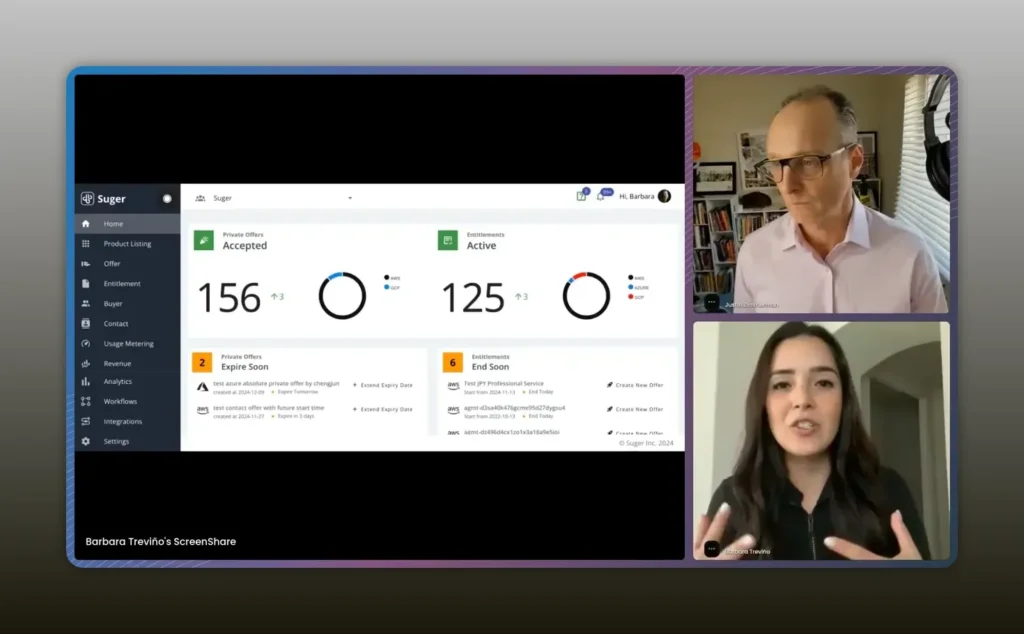

Walkthrough: Sugar Console and core capabilities

The Sugar Console is designed for all the internal stakeholders who touch marketplace: alliance directors, partner managers, deal desk personnel, RevOps, finance, and product marketers. Instead of juggling multiple cloud portals and spreadsheets, you get a single place to manage the end-to-end marketplace lifecycle.

Centralize marketplace into one single pane of glass. —Barbara Treviño

At a glance, the Console shows:

- Active and pending private offers across clouds

- Recent entitlements and upcoming renewals

- Listings status and previews

- Revenue and transaction summaries

- Workflow automations and integrations

For someone running partnerships, that visibility drastically reduces the back-and-forth between teams. Instead of asking multiple platform admins for status updates, you and your stakeholders look at one dashboard that blends marketplace data with internal CRM signals.

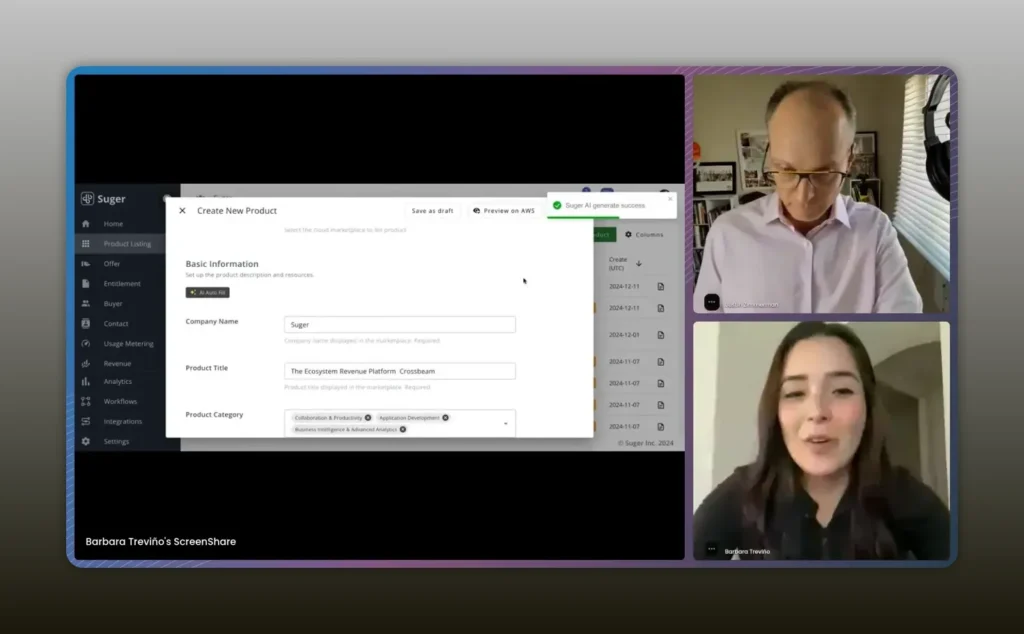

AI autofill: create listings in minutes

One of the most expensive and misunderstood parts of marketplace onboarding is the listing itself. It is not merely a marketing page; a production-grade listing touches technical descriptors, entitlement definitions, terms, pricing, and metadata required by the cloud.

Sugar’s AI autofill feature streamlines this exact step. Enter your company name or product and the Console populates the mandatory fields, offers a preview of the marketplace listing, and gives you a rapid starting point for marketing and pricing alignment. What used to take months of engineering and coordination can be done in minutes.

What is a process that normally takes months to do to configure takes us less than two minutes to do. —Barbara Treviño

Why this matters:

- Lower friction for product teams to test new listings.

- Ability to support a PLG model with separate listings per product or SKU.

- Eliminates repeated manual errors and compliance misses by pre-populating mandatory fields correctly.

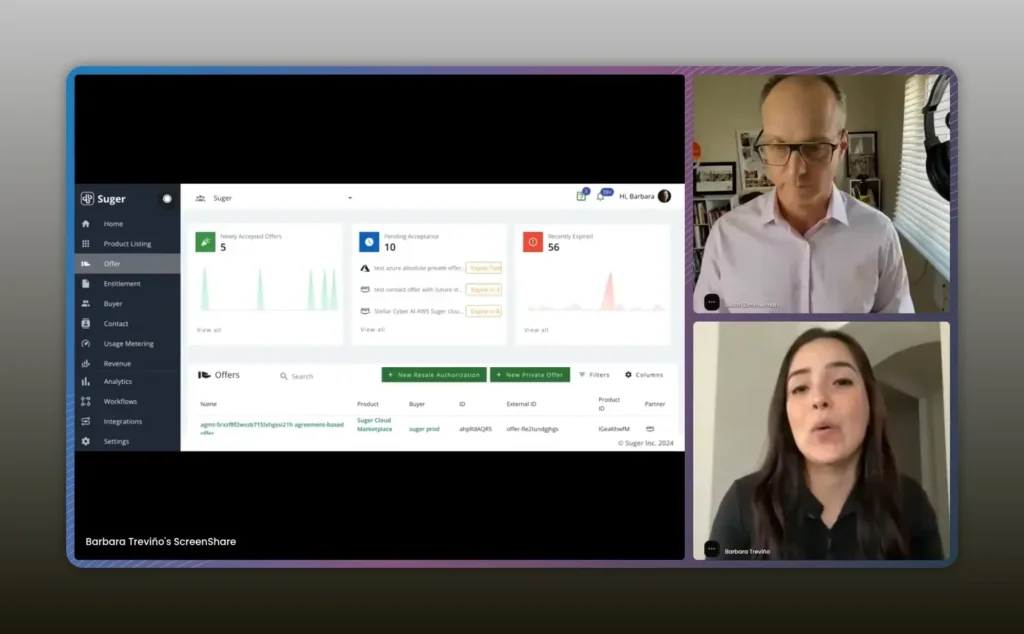

Offer management, entitlements, and renewals

Private offers and entitlements are the transactional backbone of marketplace revenue. A private offer is what your deal desk creates and submits to a buyer; an entitlement is what gets created once the buyer accepts. Managing the lifecycle of these objects requires coordination between sales, legal, finance, and platform admins.

Managing your offers from one view is very, very important. —Barbara Treviño

Key operational features to demand:

- Centralized offer queues across clouds with state tracking (pending, accepted, expiring).

- Notifications and alerts for expiring offers so sellers can avoid lost conversions.

- Automatic creation of entitlements metadata for finance and RevRec.

- Visibility into accepted entitlements and expected disbursements by cloud and by product.

If you are operating across AWS and Google Marketplace, imagine not needing separate teams to check each portal. The Console gives you a single view, standardizes permissioning, and ensures the deal desk can act quickly and accurately.

Usage metering and consumption-based billing

Subscription-only pricing is straightforward to model. Consumption models are not. Usage-based pricing is increasingly common, especially among AI and data-driven products. If you do not measure and meter usage correctly, you leave money on the table.

Sugar is an API-first company and supports usage metering directly. That matters for several reasons:

- Accurate consumption tracking ensures correct billing and fewer disputes with finance and buyers.

- Usage metadata feeds product insights: which features are actually used and at what scale.

- Enables hybrid pricing models: base subscription plus a consumption layer for high-value features.

Barbara highlighted that many Gen AI companies have complex models and Sugar helps them capture revenue they might otherwise miss. If your product uses hours, calls, or compute units as metered units, make sure the marketplace path supports metering end-to-end.

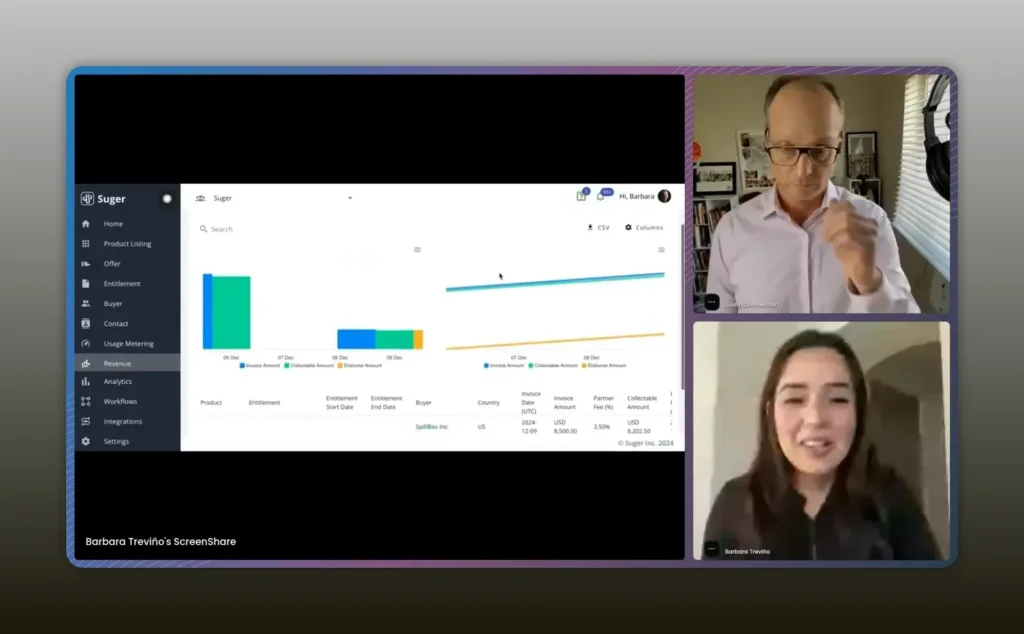

Analytics and partner attribution

Running marketplace without analytics is like flying blind. You need to know which listings, clouds, or partner relationships drive transactions and which do not.

Sugar’s analytics consolidate data from Partner Central, Partner Advantage, Partner Center, and your internal systems so you can answer questions such as:

- Which listing generated the most conversions last quarter?

- How much revenue is attributable to marketplace versus direct channels?

- Which partners and co-sell motions produce the highest close rates?

- What is the average time from private offer creation to entitlement acceptance?

Our analytics feature here is amazing because as an alliance leader reporting to your VP of partnerships or even your CRO, it’s very, very important to have this data readily available. —Barbara Treviño

Actionable analytics lead to better strategic choices: where to invest, which partners to nurture, and which product listings to optimize for higher conversion and ARR.

Workflows and integrations: gluing the org together

Marketplace touches many teams. If you leave marketplace events isolated in the partner or alliances team, you will create silos and missed revenue. The Console’s workflow automation lets you connect marketplace events to your systems:

- Trigger a CRM opportunity stage update when a private offer is accepted.

- Post acceptance events into finance systems to prepare for RevRec.

- Notify customer success of a newly entitled customer for onboarding.

- Automate renewal outreach when entitlements near expiry.

Workflows are the super glue that prevents lost deals, billing mismatches, and poor customer experiences. For companies scaling listings and transactions, this automation returns time to your people and reduces operational risk.

How to plan a fast marketplace launch

Speed and quality are not mutually exclusive; with the right plan you can move quickly and avoid rework. Here’s a pragmatic sequence to accelerate listing and adoption.

- Decide buy versus build using the decision framework above. If you choose a partner like Sugar, map the scope of services.

- Identify the first listing candidate. Choose a product that is enterprise-ready and has a clear packaging and pricing model.

- Define roles and RACI. Make sure alliance, product, legal, finance, and RevOps are aligned on deliverables and timelines.

- Use an AI-assisted listing creation tool to draft content. Save engineering cycles for integration and metering where needed.

- Set up offer templates and standard pricing rules to speed private offer creation during sales cycles.

- Configure usage metering for consumption-based products and validate telemetry.

- Integrate entitlement events with CRM and billing systems for accurate revenue recognition and customer onboarding.

- Enable analytics dashboards and baseline metrics for the first 90 days.

- Run an internal launch playbook for sales and partner teams to educate them on how to sell via marketplace and where to record attribution.

- Iterate on the listing copy, packaging, and pricing based on conversion data.

Checklist for marketplace readiness

- Listing content: description, icons, technical specs, pricing, and trial options.

- Commercial templates approved by legal for private offers and enterprise procurement.

- Offer and entitlement workflows mapped to finance and RevRec processes.

- Usage metering configured and validated if consumption pricing is used.

- CRM and deal desk integrations set up to avoid manual data re-entry.

- Analytics and dashboards configured with baseline KPIs.

- Internal enablement completed for sales, alliance, and customer success teams.

- Plan for maintenance and future marketplace feature adoption (the provider will change APIs, programs, or processes).

Common gotchas and how to avoid them

Even seasoned teams fall into similar traps. Here are the most common and how to mitigate them.

- Underestimating cross-functional alignment — Marketplace is not just an alliance play. Make sure legal, finance, product, and RevOps are at the table early.

- Failing to automate workflows — Manual handoffs create delays and missed revenue. Automate entitlement-to-CRM flows and renewal reminders.

- Ignoring usage metering — If your product supports consumption pricing and you do not meter, you will underbill.

- Designing one-off listings — If you expect to add multiple products, choose an approach that allows quick iteration and multiple listings without per-listing fees.

- Not planning for ongoing maintenance — Marketplaces evolve. Invest in a partner or team that watches changes so you don’t scramble when an API or program updates.

When Sugar is the right move

Barbara’s experience is a useful lens: after doing it in-house and feeling the pain, she joined Sugar to help other companies avoid the same trap. If you find yourself two to three months into a DIY project and still stuck in engineering cycles, or if you want to accelerate a multi-cloud launch without growing headcount, a partner like Sugar reduces time-to-market and ongoing operational risk.

Sugar’s commercial model is also noteworthy: they do not charge per listing in the way some providers do, which encourages testing and PLG experimentation. That matters when you want to run rapid market experiments across multiple products and pricing options.

Examples and brief case notes

A few real examples illustrate how the pieces fit together:

- Crossbeam-style listing: Using AI autofill, a company can generate a fully populated listing, preview it, and push it live with significantly less coordination between marketing and product.

- Gen AI startups with consumption billing: These businesses use Sugar’s metering to bill based on model usage units and avoid lost revenue due to manual tracking.

- Joint partner deals: Partner connections plus a centralized offer view prevent lost co-sell attribution and keep opportunity data consistent across multiple partners.

How to measure success

Define objective KPIs and measure aggressively during the first 90 days after launch:

- Number of listings created and published.

- Conversion rate from listing view to private offer creation.

- Time from private offer creation to entitlement acceptance.

- Revenue attributable to marketplace and month-over-month growth.

- Percentage of transactions that are consumption-based versus subscription.

- Average time to onboard a new marketplace customer post-entitlement.

These metrics should be visible to your partnerships and RevOps leaders and rolled into executive reporting so marketplace becomes a clear part of overall GTM performance.

Practical next steps

If you are deciding right now whether to invest in an in-house marketplace build or use a specialized partner, here is a short decision checklist:

- Estimate engineering and cross-functional hours needed to build and maintain a listing for six months.

- List the integrations required (CRM, finance, billing, usage telemetry) and estimate associated complexity.

- Factor in ongoing costs of adapting to marketplace changes and program updates.

- Obtain quotes or proposals from specialized vendors that provide both tech and operational expertise.

- Compare total cost of ownership and time-to-first-revenue between build and buy options.

FAQs

How long does it typically take to get a listing live if you use a specialized partner?

With a specialized partner and AI-assisted listing tools, the core listing creation can be reduced from months to hours or days. Full operational readiness including integrations and metering can range from a few days to a few weeks depending on complexity.

What is a private offer versus an entitlement?

A private offer is a commercial proposal created by a seller and sent to a specific buyer via the marketplace. An entitlement is the record created when a buyer accepts a private offer; it represents the buyer’s right to access the product for the agreed term.

Can I list multiple products and avoid per-listing fees?

Some providers charge per listing. Sugar’s approach, as described, does not charge per listing, allowing companies to create many listings without incremental cost and enabling a PLG or multi- SKU approach.

How do consumption-based pricing models work through marketplaces?

Consumption pricing requires usage metering and telemetry. An API-first partner can capture usage events, aggregate them into billing units, and feed them into marketplace billing or your invoicing processes so consumption is charged correctly.

What teams should be involved in a marketplace launch?

Cross-functional alignment is critical. Involve partnerships/alliance, product, engineering, legal, finance, deal desk, RevOps, and customer success. Each group owns specific parts of the workflow from listing content to billing and onboarding.

Is it possible to manage AWS, Google, and Azure marketplace data in one place?

Yes. A single pane of glass like the Sugar Console aggregates marketplaces into one dashboard for offers, entitlements, revenue, and analytics, avoiding the need to manage separate cloud portals.

What are typical pricing models for vendors that help with marketplace listings?

Pricing models vary. Some charge per listing, others charge a subscription or revenue-share, and some bundle services and software differently. Ask vendors about per-listing fees, integration charges, and ongoing maintenance costs.

How do I ensure partner attribution and reporting accuracy?

Use consolidated analytics that ingest marketplace data and map transactions to CRM opportunities and partner records. Automation around deal creation and acceptance reduces manual errors and maintains accurate attribution.

Conclusion

Marketplace presence is no longer optional for many B2B software businesses. It unlocks procurement friction reduction, enterprise trust, and new revenue channels. But the path from concept to live listing and recurring revenue is operationally complex. You can either invest months of internal effort and assume a maintenance burden, or you can partner with a specialist and accelerate time to market while embedding marketplace into your broader GTM motion.

Barbara’s experience—building in-house, feeling the pain, and then joining a company that solves it—highlights the trade-offs clearly. If you need acceleration, operational expertise, usage metering, and centralized analytics, evaluate a partner that gives you the single pane of glass and automation you need to scale listings across the cloud.