Partner Source Summit 2024: Unlocking Ecosystem-Led Growth and Partnership Revenue

Expert advice from Bob Moore (CEO, Crossbeam).

Snapshot

The reality is: Companies that treat ecosystems as strategic assets win bigger deals, retain customers longer, and unlock new motion for cross-functional teams. The merger between Crossbeam and Reveal, combined with the rising adoption of ecosystem-led growth, changes the playing field.

The recent vendor consolidation represents an opportunity to flip the script: instead of partnerships being an isolated team that runs events and champions a few friendly ISVs, treat the ecosystem as an operating asset that informs product prioritization, acquisition motion, and customer success playbooks. That shift requires three practical moves you can start today:

- Audit coverage: measure how much of your partner universe is visible in your chosen network and where blind spots live.

- Centralize signals: feed overlap and usage data into CRM and reporting so sales and RevOps can act on partner intent without extra effort.

- Run a short, measurable pilot: pick a handful of high-overlap partners, instrument outcomes, and show a clear delta in speed-to-close, win rates, or expansion.

If you run partnerships, RevOps, sales enablement, or product strategy, this article gives you the frameworks, practical plays, and a roadmap to turn partner potential into predictable partner-sourced revenue.

Ecosystem-led growth is not a strategy for partnership teams. It’s a strategy for companies. – Bob

Table of Contents

- Why the Crossbeam + Reveal merger matters

- How unified partner data converts into organization-level motion

- Understanding ecosystem-led growth and its role in partner-sourced revenue

- Readiness: Are you prepared to adopt ELG?

- How to prioritize partners — a practical two-by-two you can use today

- Tactical plays by department

- Using Crossbeam data to find your “Glengarry” partners

- Making the case to RevOps, Sales, and the executive team

- Events and community: why in-person relationships still matter

- Practical next steps and a one-month rollout checklist

- FAQs

- Conclusion

Why the Crossbeam + Reveal merger matters

The merger between Crossbeam and Reveal isn’t just a consolidation of two vendors. It resolves a structural blocker that partnership leaders have felt for years: fragmented networks. When half your partners live on one product and the other half on another, you end up with half-efforts, competing integrations in CRM widgets, and a lot of friction when asking RevOps or Sales to adopt partner-driven workflows.

Crossbeam brings an enterprise-grade backend: flexible ingestion of diverse datasets, advanced filtering, and nuanced sharing rules that enterprises require for privacy and compliance. Reveal brings a refined front-end experience and a user journey optimized to surface the “atomic” unit of partner value quickly — the first handshake between two teams where joint opportunities are obvious and actionable.

Combined, the product roadmap goes like this: network consolidation on Crossbeam’s backend with a front end heavily influenced by Reveal’s UX principles. That means easier account mapping, richer overlap analytics, and a user experience that accelerates adoption across teams.

Everybody will end up on the Crossbeam back end, and we’re going to have an awesome front end that feels like the best of both worlds. – Bob

How unified partner data converts into organization-level motion

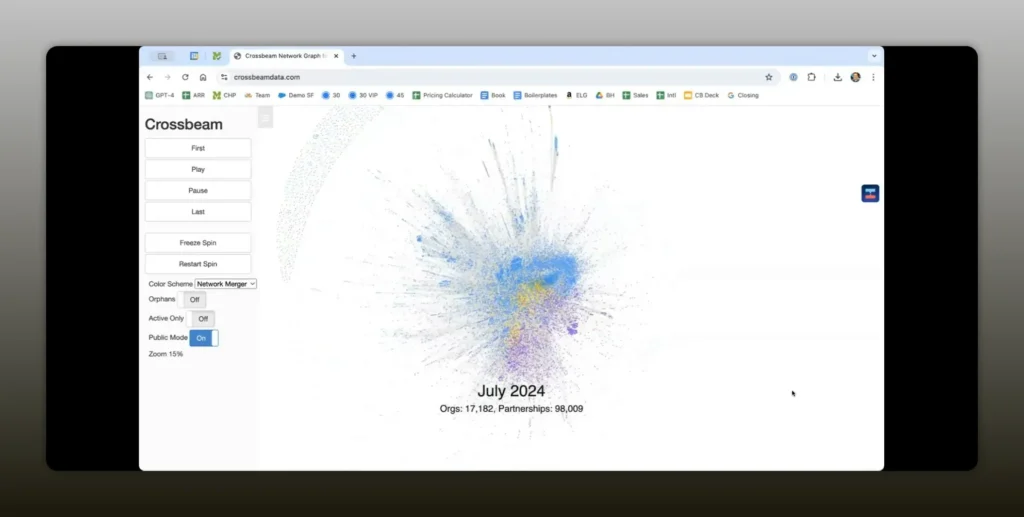

Data completeness is the lever that moves ecosystem work from a niche initiative to company-level strategy. Partner teams can do great, targeted work even with partial coverage, but the moment you try to scale adoption across sales, RevOps, and customer success, questions arise: how many partners are actually participating, and how consistent is coverage across regions and segments?

When you centralize partner relationships, integrations, and overlap analytics on a single network, you make it possible for RevOps to standardize CRM integrations, for sellers to see partner-enabled opportunities alongside their pipeline, and for marketing to tie co-marketing efforts to measurable pipeline outcomes.

More important, a unified network turns the ecosystem itself into a source of signal and intent. You no longer guess that a prospect is likely to convert because of market fit; you can see whether they use other tools in your ecosystem and whether those signals correlate with higher ACV, shorter sales cycles, or stronger retention.

There were giant chunks of teams’ networks fragmented across two platforms. Bringing them together is like finding an entire continent of customers you didn’t know you had. – Bob

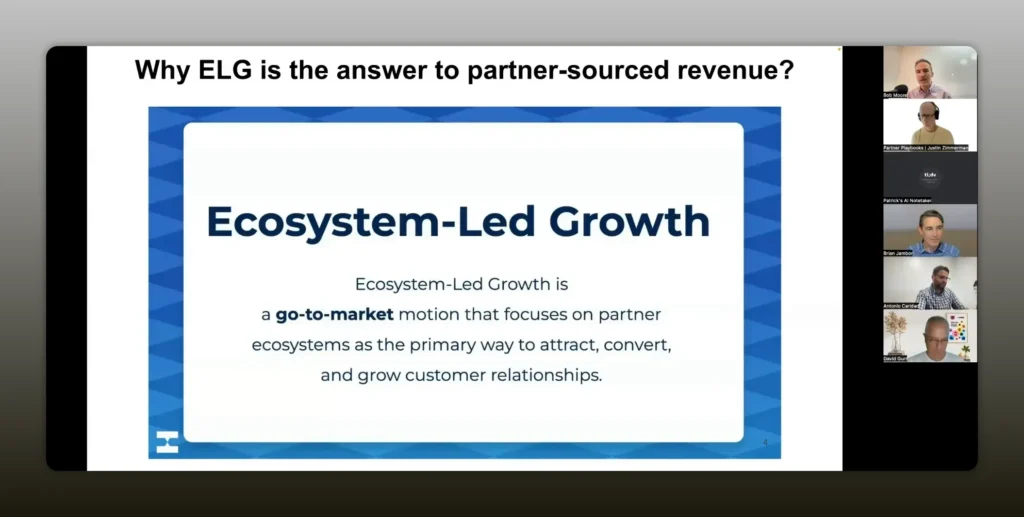

Understanding ecosystem-led growth and its role in partner-sourced revenue

Ecosystem-led growth (ELG) is not a tactic you give to the partnerships team and walk away from. ELG must live at the company level. That means the board, the CEO, and go-to-market leadership must treat ecosystems as a primary channel for acquisition, expansion, and retention.

ELG has two major benefits for partner-sourced revenue:

- Relationship-driven introductions and co-sell motion. Partners create direct pipeline and introductions that speed up deal cycles and add credibility in competitive deals.

- Aggregate signal and intent. When you can measure which combinations of tools and services a prospect uses, you discover predictable patterns: which partner combinations create better deals, which customer segments have higher lifetime value, and where to invest co-selling resources.

Once ELG rises to a strategic priority, you unlock cross-functional plays that transform partnerships from a point tactic into a replicable growth engine.

When you look at the ecosystem in aggregate it produces insights and signal and analytics that actually point you to who you should be working with and how to engage them. – Bob

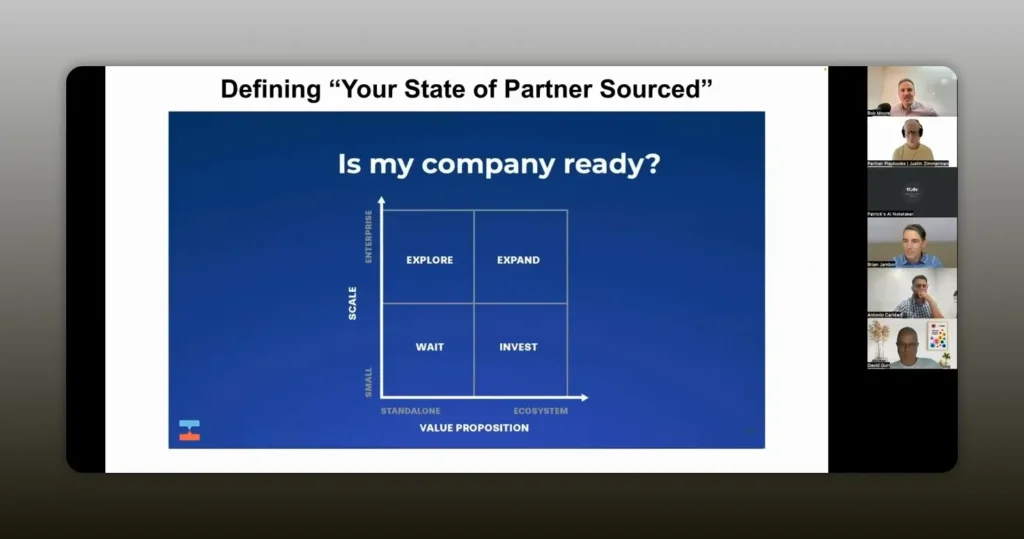

Readiness: Are you prepared to adopt ELG?

Readiness isn’t a binary test. The right question is where your company sits on two dimensions: scale and how tightly your offering is coupled to an ecosystem.

Plot your company on this matrix:

- Scale — the gravitational pull you have in the market and the degree of partner effort required to associate with you.

- Ecosystem coupling — whether your product requires third-party integrations, sits in a larger stack, or depends on service partners to realize value.

Four outcomes:

- Top-right: You have scale and are highly ecosystem dependent. This is the sweet spot for ELG. Invest aggressively.

- Bottom-right: You have ecosystem dependence but are smaller scale. Start investing early — even a single-person partner function can create measurable impact.

- Top-left: You have scale but low ecosystem coupling. For these companies the focus is on creating ELG playbooks and internalizing the ecosystem into go-to-market plans.

- Bottom-left: Small, standalone products that don’t rely on partners. ELG is often a lower priority.

The answer to readiness is allowed to be no. Identifying when it’s a no is important. – Bob

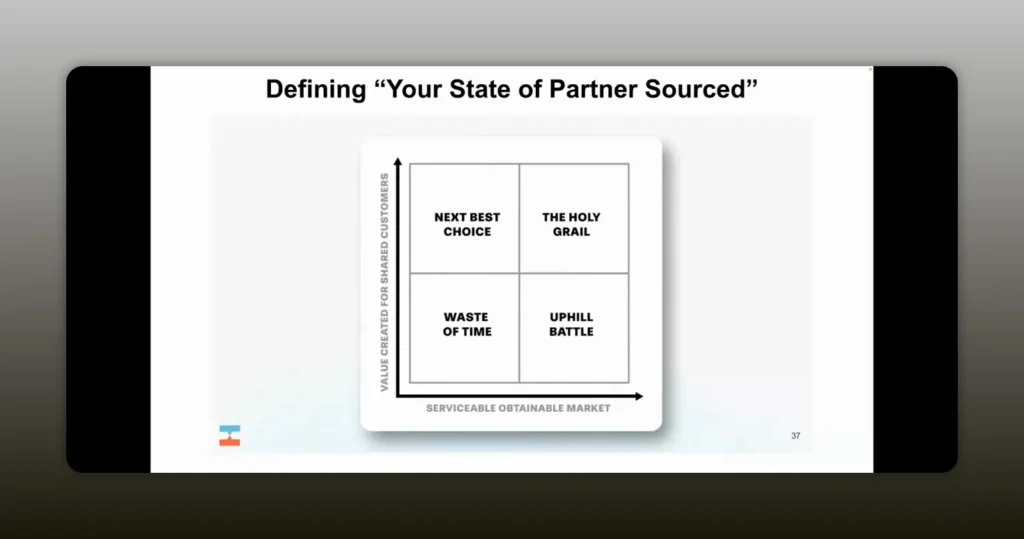

How to prioritize partners — a practical two-by-two you can use today

Once you accept that ecosystems matter, the next question is tactical: which partners should you focus on? Prioritization rests on two dimensions you can extract from your overlap data:

- Overlapping addressable market size — how many target accounts sit at the intersection between your customer base and the partner’s customer base.

- Value lift — the qualitative and quantitative difference in outcomes when a customer is common to both of you: higher ACV, better win rates, faster time-to-close, improved retention.

Multiply those two signals. The partners that score high on both are your gold partners. They produce disproportionate value and deserve priority investment in co-selling, joint GTM, integrations, and dedicated enablement.

When you find the ones where there’s a large market and that intersection produces better outcomes, that’s the gold mine. – Bob

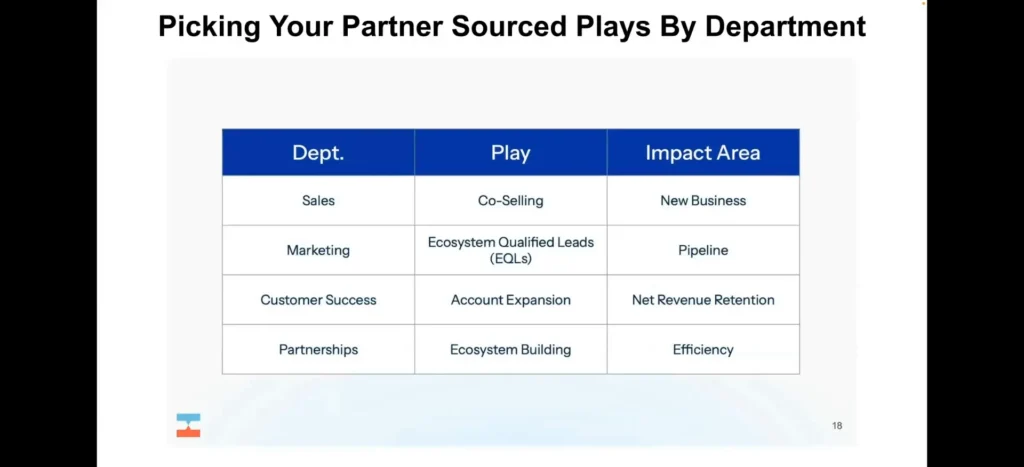

Tactical plays by department

ELG manifests differently across teams. Below are concrete plays you can begin implementing in the next 30 to 90 days.

Partner team

- Run an overlap audit to create a prioritized partner list using combined network data.

- Create tiered joint GTM plans for top partners: pilot co-selling for 3–5 target accounts, measure lift, then scale.

- Operationalize partner referral tracking to ensure partners get timely attribution and incentives.

Sales

- Embed partner signals into opportunity cadence: show sellers when a prospect uses partner products and provide specific playbooks for those situations.

- Create partner-specific nurture sequences and talk tracks so sellers can articulate joint value quickly.

- Run “partner days” where sellers and partner reps co-work accounts in real time to accelerate pipeline.

RevOps

- Standardize a single CRM integration for partner overlap to avoid competing widgets or duplicated pipelines.

- Create shared dashboards that show partner influence by stage, conversion rates, and ARR uplift.

- Automate partner attribution events to ensure clean reporting for revenue recognition and commission design.

Marketing

- Build co-marketing templates for content, webinars, and ABM plays targeted at overlapping accounts.

- Use partner overlap data to refine ideal customer profiles and target ads to accounts that contain partner signals.

- Report pipeline influenced by co-marketing, not just MQLs, so partnership impact is visible to CMOs and the board.

Customer success

- Leverage partner combos as part of onboarding plans; include partner services in success playbooks where they improve time-to-value.

- Use partner network signals to identify expansion opportunities where customers already use complementary tools.

- Track retention cohorts by partner usage to quantify long-term upside from ecosystem adoption.

Using Crossbeam data to find your “Glengarry” partners

Crossbeam’s core value becomes obvious once you treat overlap as a discovery engine. Start with three actions:

- Identify high-overlap accounts using account mapping. These are accounts that are literally sitting inside both databases.

- Analyze outcomes for overlapping accounts vs non-overlapping accounts. Look for patterns — higher ACV, shorter sales cycles, lower churn.

- Segment partners by overlap magnitude and outcome lift, then create a partner score that blends both signals to prioritize outreach, co-sell pilots, and engineering effort.

Even with a free Crossbeam account, you can pull overlap data that shows real intersections. Use that as evidence when you present to sales and RevOps. The metric you want on the slide is not brand awareness; it’s the delta in conversion or revenue for accounts that belong to your ecosystem network.

When coverage is low, your ability to get cross-functional buy-in is low. Fix the coverage problem and you open the door to company-level adoption. – Bob

Making the case to RevOps, Sales, and the executive team

Your ask should be simple: permission to run a measurable pilot that demonstrates partner impact on pipeline and retention. Structure that pilot like a product experiment:

- Define a clear hypothesis (for example: accounts where partner X is present close 20% faster).

- Choose a measurable population and timeframe (3 months, 50 pilot accounts).

- Instrument the CRM and dashboarding so every stage is tracked and partner attribution is captured.

- Report wins and iterate: if the pilot shows lift, ask for expanded resources; if not, analyze why and adjust the partner mix or playbooks.

Executives respond to risk-managed pilots that promise measurable outcomes. Frame ELG as a revenue optimization lever, not merely a channel expense.

Events and community: why in-person relationships still matter

Tools and data make ecosystem scaling possible, but in-person relationships remain the glue. Events like Catalyst and active communities such as Partnership Leaders accelerate trust, uncover collaboration opportunities, and shorten sales cycles by turning acquaintances into allies.

You can treat events two ways:

- As a matchmaking engine: curate sessions and meetups that connect your sellers with partner reps for co-selling conversations.

- As a learning engine: bring tactical sessions that teach playbooks to non-partnership teams so they know how to use partner signals in their workflows.

Allocate budget for event attendance early. The relationships you form there travel with you when you change jobs and continue delivering network effects across your career.

If you feel alone or isolated, events are where you find the missing pieces of your partner program. – Justin Zimmerman

Practical next steps and a one-month rollout checklist

Here is a pragmatic 30-day plan you can follow to move from intention to action.

- Run a quick overlap audit using your existing partner data and any free Crossbeam features to get a baseline of coverage.

- Create a prioritized partner list using the overlap-by-magnitude and outcome-lift framework.

- Design a measurable pilot with Sales and RevOps: 30–60 accounts, 8–12 week period, clear KPIs.

- Instrument CRM and dashboards to capture partner signals, attribution, and conversion deltas.

- Run enablement for sellers: one-pagers, playbook scripts, and a shared Slack channel with partner reps.

- Execute co-sell or referral outreach to the top 3–5 partners and launch pilot.

- Collect results, iterate on playbooks, and prepare a concise executive summary showing measured impact.

These steps force a bias toward measurable outcomes and give you evidence to scale partner investments intelligently.

FAQs

How fast will the Crossbeam and Reveal networks be fully merged?

The migration is gradual. Crossbeam’s backend will host the unified network, while Reveal’s front-end design principles will heavily influence the product UX. Some customers will move quickly; others with complex implementations will migrate more slowly. The timeline is measured in months rather than weeks to avoid disrupting customer setups.

Will I lose functionality from either product after the merger?

The plan is to preserve the best of both products: Crossbeam’s data and sharing architecture and Reveal’s user experience. Crossbeam has been integrating design and engineering teams from Reveal to create a unified product that improves functionality over time. Existing features are being handled carefully to avoid abrupt removal.

What if my partner network is only partially on the unified platform?

Partial coverage still offers value. Start with the portion of your network that’s on the platform and run pilots that demonstrate lift. Use those results to build a business case for wider adoption across partners and for cross-functional investment from sales and RevOps.

How do I prioritize which partners to invest in first?

Prioritize partners by a two-dimensional score: size of overlapping addressable market and the impact on customer outcomes when you share customers. Partners with both large overlap and positive outcome lift are your highest priority.

Can small companies adopt ELG or is it only for larger firms?

Small companies can and should adopt ELG if their product is coupled to an ecosystem. Even with limited headcount, focused investments in the right partners and measurable pilots can yield outsized returns.

How should I measure partner-sourced revenue?

Measure partner influence through a combination of metrics: pipeline influenced, conversion lift for overlapping accounts, ACV differential, and retention cohorts. Instrument your CRM to capture partner touchpoints and use dashboards that demonstrate revenue impact, not just leads.

Conclusion

The era of fragmented partner networks and half-hearted partner programs is ending. With joined-up data, a user experience designed to surface the highest-value overlaps, and a deliberate shift from partnership tactics to company-level ecosystem strategy, you can build a repeatable, measurable engine for partner-sourced revenue.

Start small with a measurable pilot, prioritize partners using overlap and impact, and use data to make the case to RevOps and the executive team. Invest in relationships through events and communities. Measure outcomes. Iterate. When you do that, partnerships stop being a side project and become a growth multiplier for your business.