Zero to $30M: Launch Multi-Million Dollar Programs In 12 Months

Expert advice from Greg Portnoy and Justin Zimmerman.

Introduction

According to Kyler Poyer, the biggest untapped growth lever in modern go-to-market is: partnerships! The opportunity is simple and urgent. When partnerships are built with intent, data, and repeatable processes, they produce better win rates, larger contract values, shorter sales cycles, and superior customer lifetime value at a fraction of the headcount cost of direct channels. When partnerships are left unstructured, under-resourced, and misunderstood, they become a source of frustration, wasted time, and missed revenue. If you feel the same way, this article will walk you solving these issues as Greg explains his “Zero To 30 Million Dollar” partner playbook!

Partnerships are the biggest untapped growth lever — when built with data and repeatable processes they outperform direct channels on win rate, ACV, and time‑to‑value. – Greg Portnoy

Table of Contents

- Introduction

- Why start with executive and cross-functional alignment

- Setting realistic goals and managing up

- Critical KPIs and why the CRM is your source of truth

- Reporting up: narrative, cadence, and proof

- Defining and testing your Ideal Partner Profile

- Designing your partner program like a product

- Incentives: the Chinese menu approach

- Onboarding, enablement, and the partner lifecycle

- Activation: 30-60-90 plans and shortening time to value

- Partner portals, PRMs, and when to scale with a platform

- Operationalising partnerships: partner ops and CRM integration

- Driving predictability, scale, and the seat at the GTM table

- Case study highlights and measurable outcomes

- FAQs

- Conclusion

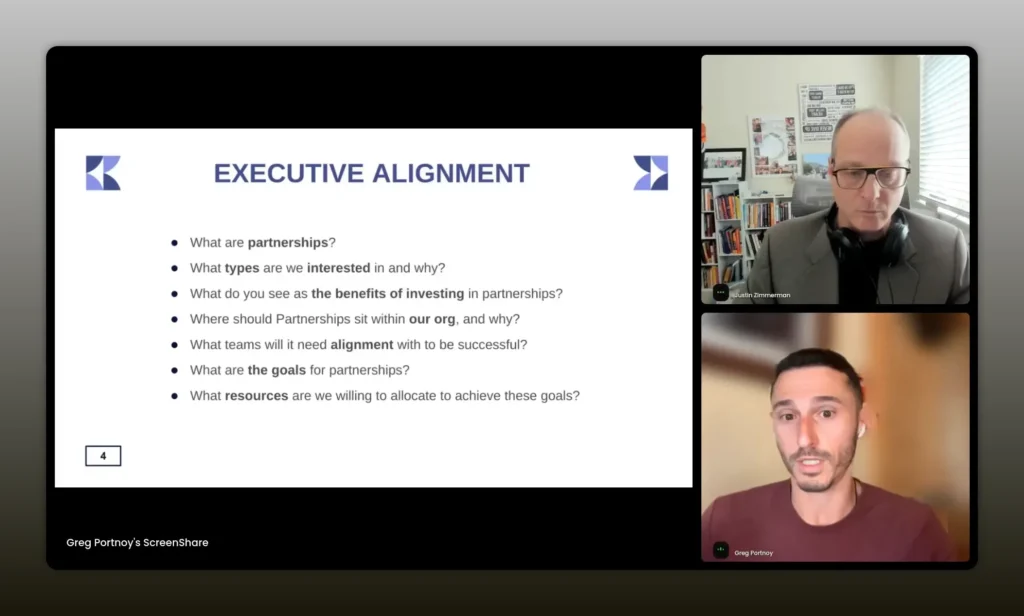

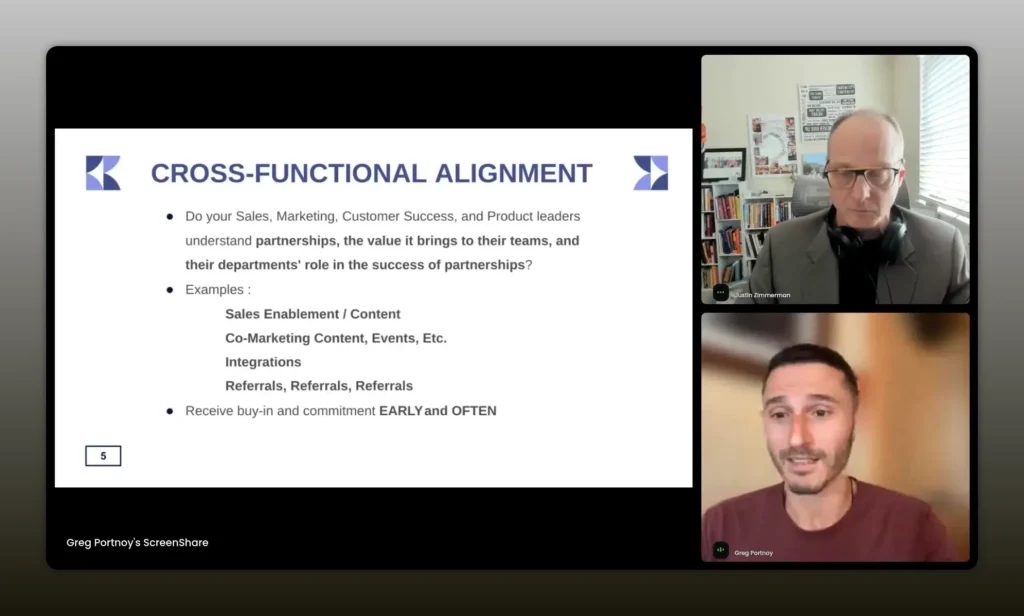

Why start with executive and cross-functional alignment

If you want partnerships to move from a tactical experiment to a predictable revenue engine, start with alignment at the top. Executives who have never owned partnerships often don’t understand the complexity, the dependencies, or what success looks like. That gap becomes a constant source of friction for partner leaders trying to get resources.

Ask for clarity on the role partnerships should play. Is the company aiming for partner-sourced revenue? Co-sell motions? Expanded distribution? Each objective changes the operating model and the resourcing you will require. One simple rule of thumb: if you want partnerships to deliver 30 percent of revenue, expect to allocate roughly 30 percent of the cross-functional resources—sales ops, marketing, product, and customer success—to support those partners. Without that share, the partner leader becomes a one-person band trying to orchestrate an orchestra.

Practical steps you can take today:

- Schedule a kick-off with the CEO, CRO, and CMO to define the north star for partnerships.

- Map the dependencies—who must do what for a partner to close a deal? Who on product needs to prioritize integrations? Who on CS will support onboarding?

- Set a top-line expectation: what portion of revenue and pipeline are you aiming to deliver via partners in 12 months?

Get executive alignment first — partnerships become a predictable channel only when the CEO, CRO and CMO agree on role, resources, and outcomes. – Greg Portnoy

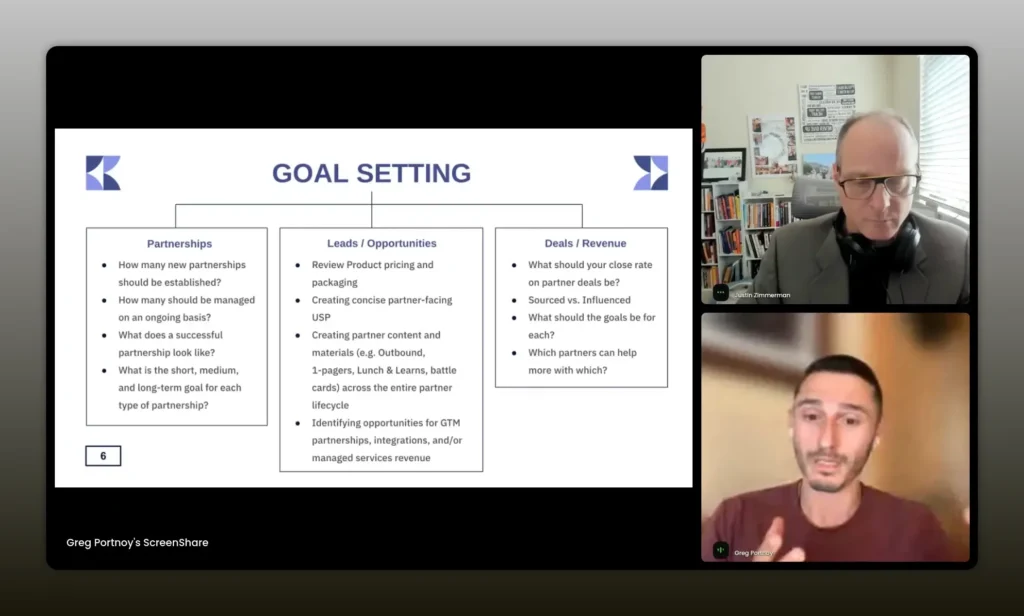

Setting realistic goals and managing up

Goals are everything. They define what success looks like and determine how much time you spend building a foundation versus scrambling to hit unrealistic quarterly targets. Many partner leaders inherit targets they did not help set. The outcome is a constant firefight and no durable program. Avoid that trap.

When senior leaders hand down an aggressive target, reverse engineer it with them. Ask for the how. Make them explain the assumptions: how many partners, what average deal size, what activation rate, and what time-to-first-deal. Reverse engineering maps expectations to inputs and reveals whether the target is achievable with current resources. If the math doesn’t work, you gain two outcomes: you either get the resources to make it possible, or you recalibrate expectations before you waste months chasing impossible KPIs.

Communication techniques:

- Use Chris Voss’s negotiation method: when given a number, ask “How?” and get them to walk through the steps they expect you to take.

- Create a 30/60/90 roadmap for the first 12 months and tie milestones to required cross-functional commitments.

- Make managing up a non-negotiable part of your routine—regular, short updates to explain what you need and why.

Goals are everything — reverse‑engineer targets by asking “How?” and map the inputs: number of partners, ACV, activation rate, and time‑to‑first‑deal. – Greg Portnoy

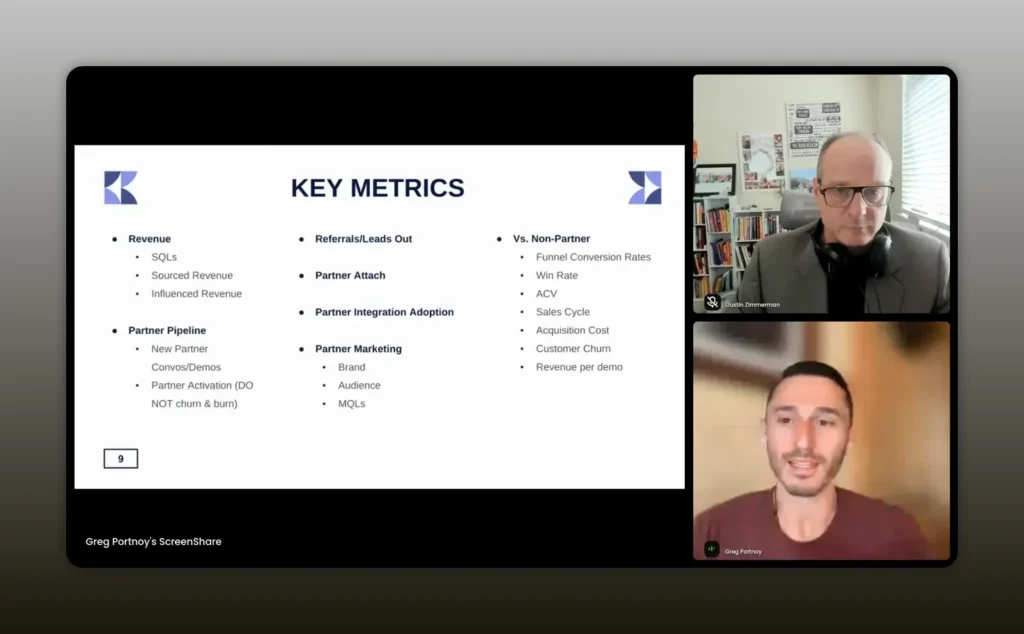

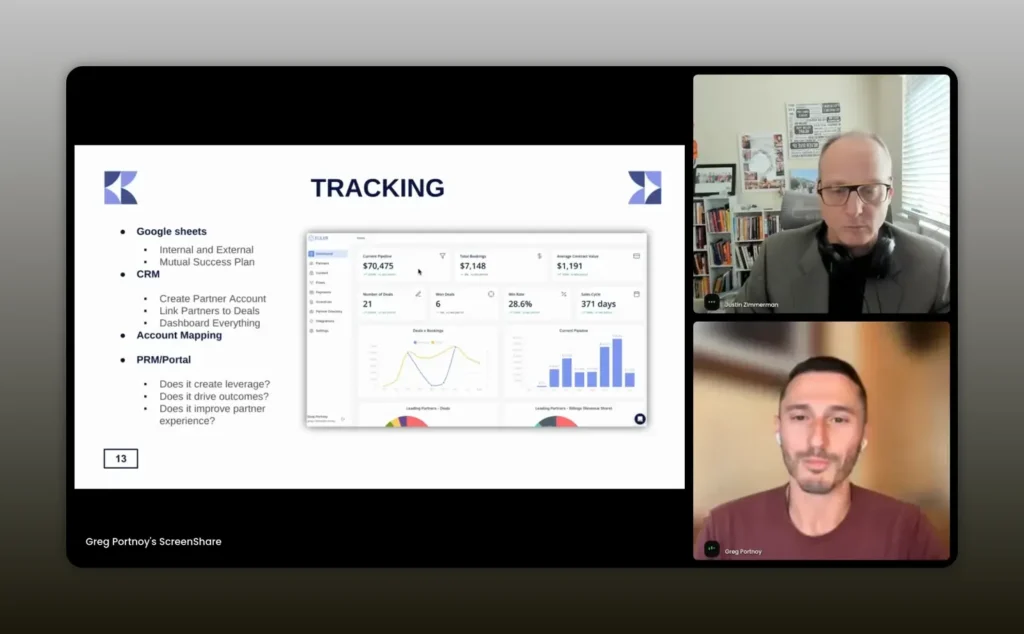

Critical KPIs and why the CRM is your source of truth

Partners generate different kinds of value than direct channels. They typically convert faster, close for higher ACV, and produce better net retention. But these advantages only matter if you can prove them with bulletproof data. Executives will question your numbers unless they are recorded in the company’s source of truth: the CRM.

Key metrics to track and report:

- Partner-sourced pipeline and bookings by stage and time period

- Average contract value compared to direct sales

- Win rate by partner type

- Sales cycle length for partner deals vs direct deals

- Customer lifetime value and churn for partner-referred customers

- Revenue per partner and revenue per partner manager

Make the CRM your launchpad. CRMs are not perfect for partnership workflows, but they are trusted by finance and revenue leaders. If you can map partner touchpoints into the CRM—deal registration, referral, partner attribution—you build a credible source of truth. That removes skepticism and makes it easier to secure more resources.

Data tells the story partners can’t tell with anecdotes alone. If it lives in the CRM, it becomes indisputable. – Greg Portnoy

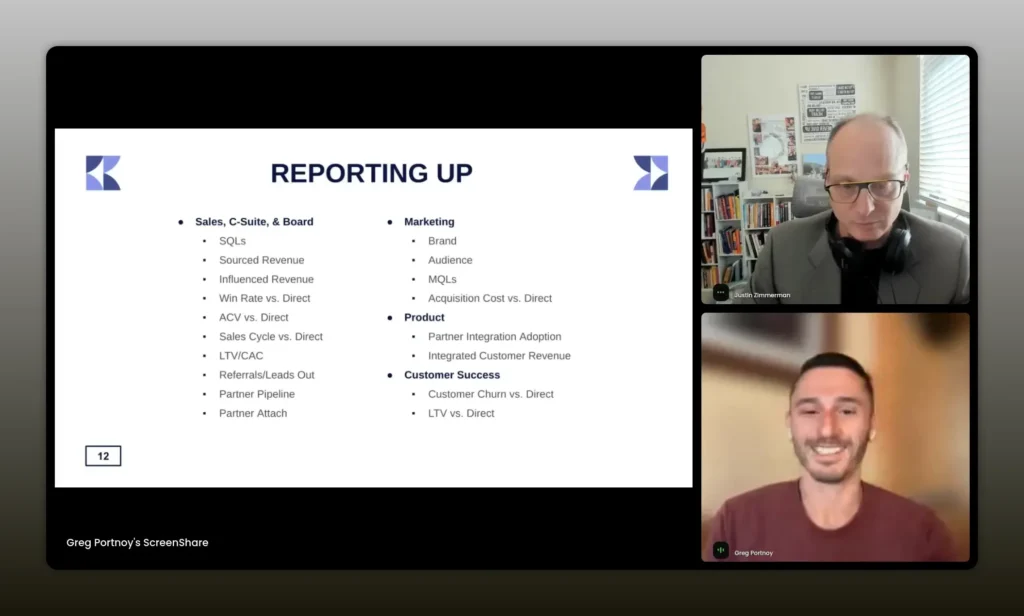

Reporting up: narrative, cadence, and proof

Tracking KPIs is half the battle. The other half is presenting them. Executive stakeholders form narratives quickly. If you do not create the narrative of partnership success, one will be created for you—often one that undervalues your work.

Build a simple reporting cadence:

- Weekly operational snapshot for GTM partners: pipeline movement, key activations, flagged issues.

- Monthly executive scorecard: partner-sourced pipeline, bookings, trends vs prior months, and a one-line agenda item asking for help on blockers.

- Quarterly business reviews with the CRO and CFO: show comparisons to direct channels, LTV:CAC, and headcount ROI.

Start in spreadsheets if needed. Proof is more important than the tool. Use a spreadsheet to prove a thesis; once you have volume and traction, move to a dedicated partner operations system that syncs bi-directionally with your CRM. The goal is to make reporting effortless and credible.

A system is the difference between chaos and scale. Build a measurable process first, then buy the tech. – Greg Portnoy

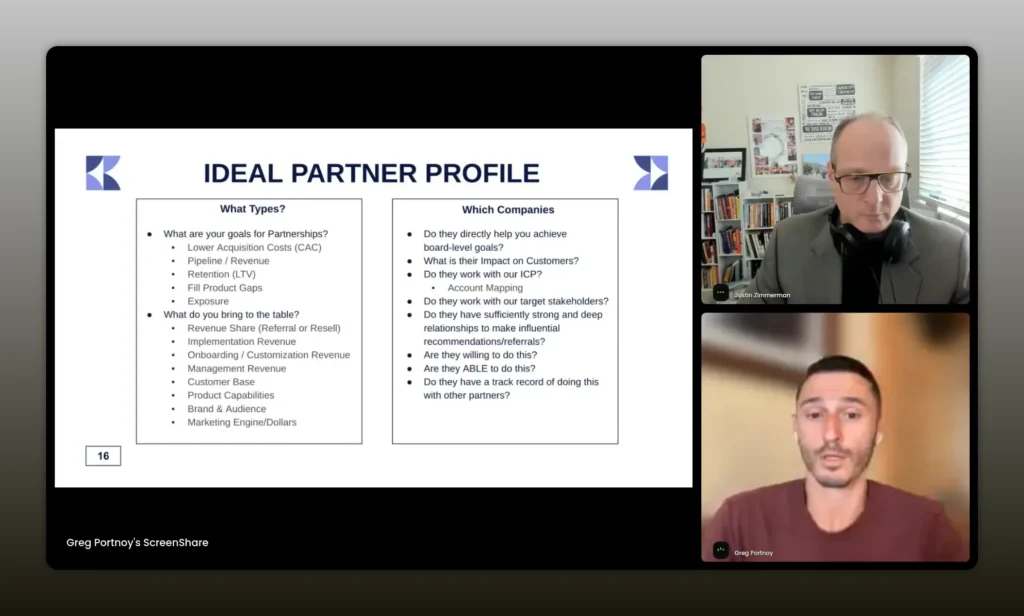

Defining and testing your Ideal Partner Profile

Your Ideal Partner Profile is a hypothesis. Treat it like a product experiment. Too many partnerships leaders go wide without testing different partner types and incentives. The right approach is to segment, test, and iterate.

How to run the experiments:

- Identify three high-level partner archetypes relevant to your customers—consultancies/agencies, technology integrations, referral resellers or marketplaces.

- Within each archetype, pick three specific targets and design tailored offers and engagement plays for each.

- Run small, measurable experiments for each target: outreach, co-marketing pilots, integration projects or referral plays.

- Measure activation rate, time-to-first-deal, average deal size, and expansion opportunities. Use the data to refine the profile.

Your Ideal Partner Profile will evolve as the company and market change. Treat it as living data, not a one-time declaration.

Run it like product: hypothesis, experiment, measure, iterate. The best partners are discovered, not declared. – Greg Portnoy

Designing your partner program like a product

Think of your partner program as a product you take to market. Your program includes offers, tiers, enablement, incentives, and an experience. Designing it requires clarity about value exchange. What does your company give, and what do you expect in return?

Core components of a market-ready partner program:

- Clear partner tiers and what each tier delivers

- Defined onboarding flow with milestones

- Enablement: playbooks, training, certifications

- Attribution and reporting rules

- Co-marketing and co-selling packages

- Incentive mechanics and payout cadence

Start with a minimal viable partner program—V1 that is repeatable and measurable. Iterate based on which elements move the needle. Most successful programs are built over quarters, not weeks.

Partners are your customers. Build their onboarding and enablement like you would for your SaaS product. – Greg Portnoy

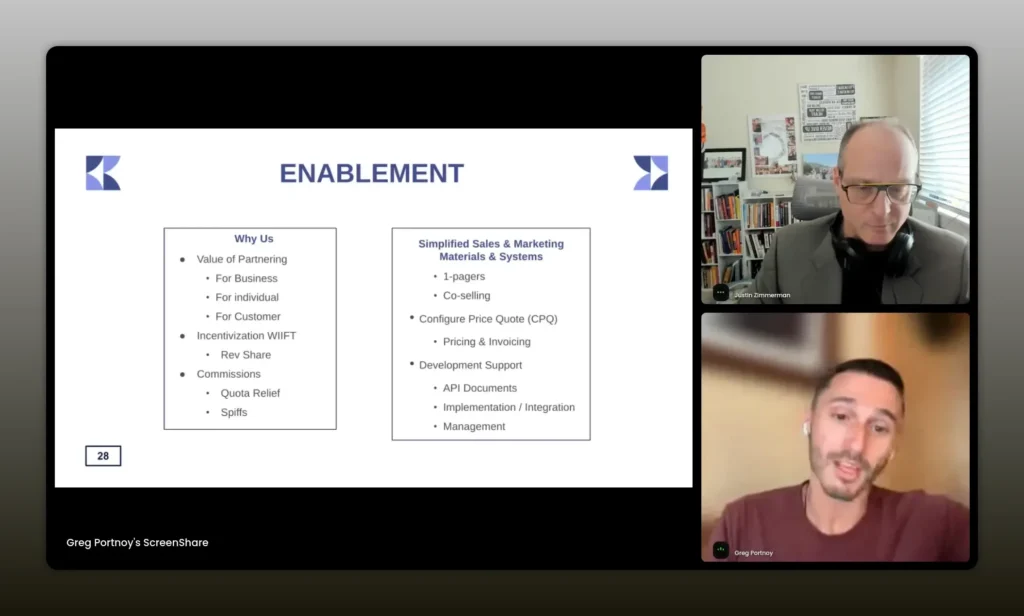

Incentives: the Chinese menu approach

There is no one-size-fits-all incentive. Partners are independent businesses with different motivations. Your job is to map what you can offer to what they value.

Common incentive levers:

- Monetary: commission, rev share, referral fees

- Quota retirement: crediting partner sales toward quotas

- Services revenue: joint implementation or managed services

- Co-marketing budget and exposure

- Access to your sales or product resources

Design a menu of incentives and match them to partner archetypes. For example, agencies may value co-billing or services opportunities; technology partners may prioritize joint integrations and co-marketing; referral partners may prefer high-velocity commissions. Offer flexibility, but standardize where you can to minimize operational complexity.

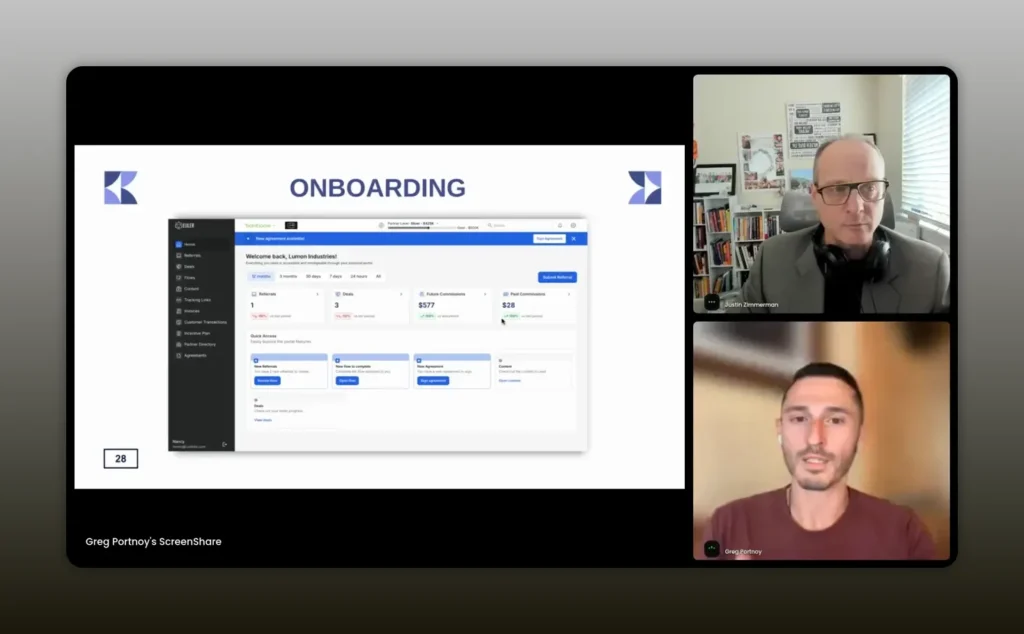

Onboarding, enablement, and the partner lifecycle

Signing a partner is the easy part. Activation and continuous engagement are what drive long-term revenue. Build a lifecycle that moves partners from recruitment to activation to growth.

Elements to include in the lifecycle:

- Pre-qualification and partner profile capture

- Structured onboarding flow with checklist

- Training and certification tracks

- Marketing assets and co-brandable content

- Deal registration and referral pathways

- Ongoing engagement with triggers and nudges

Adoption of partner portals has historically been low. The average partner portal adoption over decades is around 10 to 15 percent. The solution is multi-channel engagement. Push the portal content through email, Slack, and programmatic notifications so partners receive information where they already spend time.

Portals alone are not enough. Push enablement to partner-facing teams and make it frictionless. – Greg Portnoy

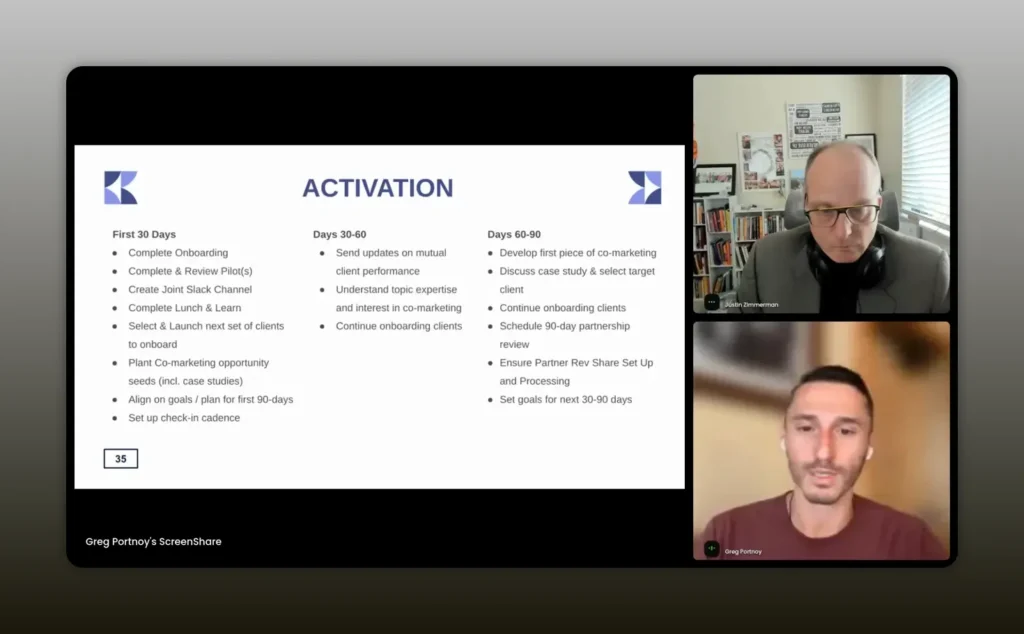

Activation: 30-60-90 plans and shortening time to value

Activation is the single most important early metric. Time-to-activation is time-to-value. The faster a partner demonstrates value, the more likely they are to stay active and invest effort in your business.

Create a 30-60-90 joint plan for strategic partners. Share it publicly in the partner portal, and use it as the blueprint for co-selling and co-marketing efforts. The plan can include activity metrics, pipeline milestones, and revenue goals. For the broader base of partners, create leaner, programmatic 30-60-90 templates that scale.

Activation checklists should be measurable and automated where possible. Track the activities that predict success—number of joint meetings, demo installs, qualified lead submissions, or pilot completions. Use those early signals to invest more in high-potential partners and to prune lower-performing relationships.

Activation is alignment plus execution. A simple, shared 30-60-90 reduces ambiguity and speeds time to value. – Greg Portnoy

Partner portals, PRMs, and when to scale with a platform

There are three phases to tooling maturity:

- Proof of concept: spreadsheets, CRM fields, and manual tracking

- Early scale: lightweight tools like Crossbeam for overlap, or HubSpot apps for workflows

- Scale and predictability: a full partner revenue growth engine or PRM that integrates bi-directionally with your CRM

Start with the simplest tool that proves the thesis. If you have volume, a platform becomes necessary to keep the program efficient. A mature platform should do more than host a partner portal. It should automate attribution, feed your CRM, support deal registration, enable partner marketing, calculate commissions, and provide orchestration of partner journeys.

When evaluating platforms, look for:

- Bi-directional CRM sync (Salesforce, HubSpot)

- Attribution that maps to deals automatically

- Portals plus multi-channel push notifications

- Journeys, enablement, and LMS capabilities

- Automation for deal registration, referral capture, and commission calculation

Buy tech when the process is repeatable and you need to scale; don’t let tech mask a weak process. – Greg Portnoy

Operationalising partnerships: partner ops and CRM integration

Partner operations is the backbone of a scalable program. If you want your partner program to be credible, invest in ops early. That might mean partnering with revenue operations to get 50 percent of a sales ops resource time or hiring a dedicated partner operations hire.

Core operational tasks:

- CRM object architecture for partner accounts, partner contacts, and partner-attributed opportunities

- Automated deal attribution and deal lifecycle mapping

- Integration with tools like Crossbeam for mutual account mapping

- Automated partner notifications and weekly attribution updates

- Commission calculation and payout automation

Good partner ops makes data reliable and reporting credible. Bad partner ops makes accurate attribution impossible and undermines trust with finance and the rest of GTM.

Invest in partner ops. Without it, you can’t scale attribution, reporting, or compensation. – Greg Portnoy

Driving predictability, scale, and the seat at the GTM table

Predictability is the final objective. When you can forecast partner-driven outputs for a given level of input and resource allocation, the business will treat partnerships as a first-class channel. Predictability comes from repeatable processes, a measurable partner funnel, and clean attribution into the CRM.

Two practical guardrails:

- Standardize partner lifecycle stages so you can measure conversion rates at each step.

- Segment partners and apply different operating rhythms to low-touch vs high-touch relationships.

Once you achieve repeatable conversion metrics and reliable attribution, you can make the financial case for headcount, budget, and strategic investment. That is when partnerships earns its seat at the core GTM table.

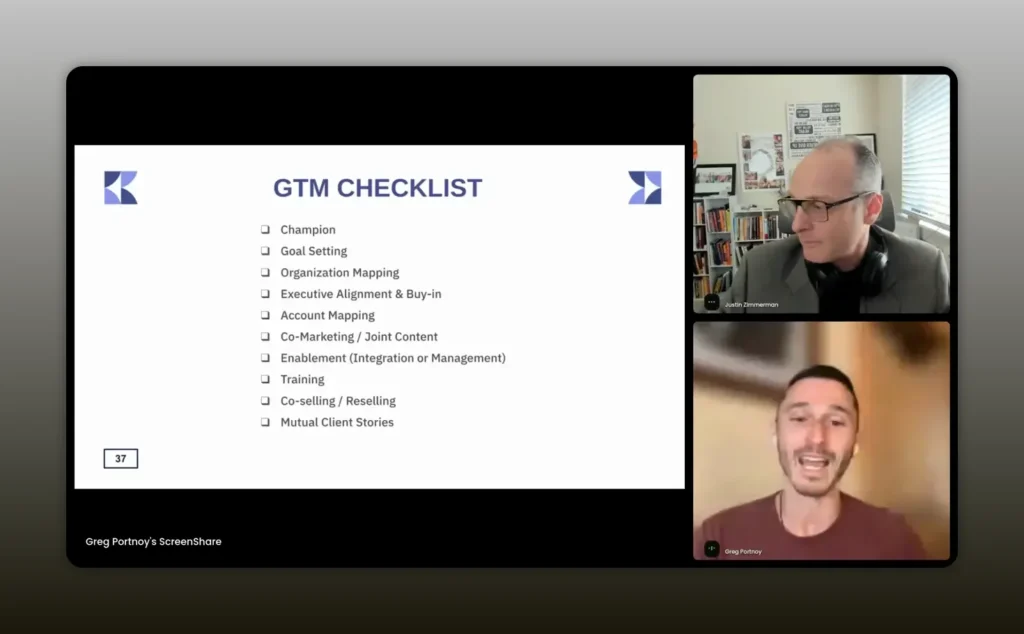

Case study highlights and measurable outcomes

Across multiple companies and programs, the results of a disciplined approach to partnerships are consistent:

- Partner teams growing to represent 25–30 percent of revenue with a 1 to 50 partner-to-sales headcount ratio at scale.

- Small companies where partnerships became 50 percent of new business after a revised GTM and focused partner play.

- Early-stage programs that scaled 3 to 4x partner revenue with platform-led automation and better enablement.

- Partner portfolio expansion of 4 to 9x when programmatic enablement replaces manual chasing.

- Average savings in partnership headcount costs through automation in the tens of thousands of dollars annually per program.

These are not magic numbers. They are the logical outcomes of consistent focus on alignment, data, process, and enablement.

The GTM checklist is your activation blueprint—if it isn’t checked, it can’t scale. – Greg Portnoy

FAQs

How do I get executive buy-in for a partner program when my C-suite doesn’t understand partnerships?

Start the conversation by reverse engineering the targets with them. Ask for the how. Build a simple model that ties partner headcount, activation rates, average deal size, and time-to-first-deal to the revenue target. Show the math and highlight required cross-functional commitments. Use short, consistent reporting cadences to maintain momentum and visibility.

What are the most important KPIs to track for a partner program?

Track partner-sourced pipeline and bookings, win rate, average contract value, sales cycle length, revenue per partner, activation rate, and LTV:CAC for partner-referred customers. Make sure these metrics are reflected in the CRM so finance and revenue leaders can validate them.

When should I invest in a partner platform or PRM?

Invest in tooling once you have a repeatable process and volume that requires automation. Start with spreadsheets and CRM fields to prove the thesis. When you need bi-directional CRM sync, attribution automation, partner journeys, and scalable enablement, it’s time to evaluate platforms that act as a partner revenue growth engine.

How do I design incentives that actually motivate partners?

Treat incentives like a menu. Map incentives to partner archetypes and offer flexible packages. Include monetary options like rev share, but also non-monetary incentives such as co-marketing exposure, services opportunities, quota retirement, and prioritized support. Test and iterate to determine what drives activation and deal flow for each partner type.

What should a partner 30-60-90 plan include?

A joint 30-60-90 should include measurable activities and outcomes: discovery meetings, enablement completions, pilot or integration milestones, first qualified referral, and initial revenue or pipeline targets. Share the plan in the partner portal and review progress regularly to keep the partnership on track.

Conclusion

Partnerships are a scalable, high-leverage channel when you build them with the same rigor you apply to product or sales. Start with executive alignment, instrument your data in the CRM, define and test your Ideal Partner Profile, design your program like a product, and operationalize with partner ops and the right tooling. Activation, enablement, and predictable attribution turn partner relationships from hopeful experiments into a dependable revenue engine. Follow these fundamentals and you can realistically move from zero to meaningful partner-sourced revenue—and earn a seat at the GTM table.