How Partnership Leaders Earn $500K+: Models, Mindset, and Methods

Expert advice from Tai Rattigan and Katie Landaal

Snapshot

As a partnership leader, what you build and how you tell its story determine whether you remain an undervalued tactician or become a compensated executive driving tens of millions in impact.

The difference between a mid-level manager and a six-figure leader is not just tenure — it is measurable business outcomes: sourced and influenced revenue, CAC delta, shortened sales cycles, margin improvement, and repeatable pipeline that scales.

It is this discipline of benchmarking your role and program against comparable ecosystems, modeling partner unit economics, and aligning partner incentives directly to company profitability that gets you a set at the table.

Don’t forget translating partner activity into CFO-friendly dashboards and a 6–12 month roadmap with milestones and ROI projections you can present to the executive team!

Sure it’s a lot.

But you want to be paid a lot! So keeping reading to find out how the highest paid partnership leaders do it all without burning out!

Your compensation is based on your mindset, your modeling, and the measurable outcomes you create. -Tai Rattigan

Table of Contents

- Why benchmarking matters

- Mindset: shared ownership vs demands

- Methodology: model what top ecosystems do

- Katie’s career trajectory and lessons

- Short-term plays you can launch this quarter

- Long-term, high-value activities that scale

- Integrations, resellers, and the CAC story

- How to work with your CFO

- Using the partner compensation calculator and data

- Scripts: how to have the compensation conversation

- Measuring ROI and telling the revenue story

- Common mistakes to avoid

- Implementation roadmap

- FAQs

- Conclusion

Why benchmarking matters

Benchmarking is the backbone of any serious compensation or strategy conversation. When you point to specific ecosystems, roles, and compensation structures, you transform subjective opinion into objective data. Benchmarking answers two questions simultaneously: which partner ecosystem should you attach your strategy to, and which internal partner program should you model.

Tai built an ecosystem compass that ranks partner ecosystems by two simple metrics: the opportunity they create for partners and the investment the platform makes. That framework gives you clarity on where to allocate your time and which strategic relationship will give you the highest leverage.

These are the ecosystem plays that you should really be emulating. -Tai Rattigan

Mindset: shared ownership vs demands

Mindset changes everything. If you approach your compensation conversation as a complaint, you will produce resistance. If you approach it as a collaborative initiative, you create a pathway forward. Shift from “You’re underpaying me” to “Here is benchmarking and a shared plan to get me to market levels.”

The conversation formula that works: do your research, present comparable peers, and invite your manager to co-design a six-to-12-month roadmap. That simple change in framing moves the dialogue from adversarial to mission-driven. Managers love a problem that has a roadmap built into it.

Methodology: model what top ecosystems do

You do not need to invent the wheel. Look at the partner programs that deliver the results you want and copy the core elements. That means identifying programs with similar company size, customer profile, and go-to-market model and adopting the structures that led to their success.

The ecosystem compass approach breaks this into three steps:

- Assess ecosystems by partner opportunity and partner program investment.

- Map which partner play is best for your stage: reseller, ISV integrations, consultancies, or referral networks.

- Emulate program structures, compensation models, and enablement rhythms that match your maturity and ICP.

Katie’s career trajectory and lessons

Katie’s path shows how breadth and translation skills compound value. She began in scrappy, hands-on roles at small marketing agencies and progressed through larger systems — Ingram Micro, transformation projects from hardware to cloud, and then into enterprise SaaS leadership at ZoomInfo.

Key takeaways from Katie’s journey:

- Wear multiple hats early. Getting into the weeds (accounting, packing boxes, direct client negotiations) produces intuition about what scales and what doesn’t.

- Translate outcomes into language leadership values. Brand awareness, credibility, and downstream revenue matter — show them.

- Use mentors widely: leaders from different industries will teach you what leadership metrics matter.

- Start programs in a hodgepodge and formalize them. That messy starting point gives you real data to iterate on.

Being in the weeds but then seeing the big picture helps you translate partner activities into business outcomes. -Katie Landaal

Short-term plays you can launch this quarter

You need quick wins to build credibility and to defend the team when budgets tighten. Short-term plays are low-friction, immediate, and measurable.

- Referral programs: Formalize a referral flow, create clear incentives, and track referral-to-revenue timelines.

- Affiliate networks: Build or partner with affiliates who can drive top-of-funnel conversions rapidly.

- Co-marketing sprints: Two-week campaigns with partners that produce measurable pipeline and case studies.

- Pilot reseller bundles: Test a small reseller integration with clear metrics for CAC and LTV differences.

These tactics produce immediate topline that you can point to when talking to the CFO about continued investment.

Long-term, high-value activities that scale

Long-term plays deliver asymmetric returns. They take patience, financial modeling, and executive sponsorship, but once they scale, they massively expand your leverage and justify senior compensation.

- Strategic GSIs and consultancies: Relationships with Deloitte, Accenture, and similar firms can take a year to mature, but one successful GSI relationship can produce millions of ARR and launch multiple closed-won opportunities.

- Reseller networks: Architecting an efficient reseller model that lowers your CAC by 20 to 30 percent can justify headcount and compensation investments.

- Product integrations: Select integrations that deliver clear monetization levers or usage expansion for your customers.

- Partner sales motions: Move beyond influence-only to co-sell and sourced deals with clear handoffs and SLAs.

If a reseller‘s overhead is 30% less than internal motion, leadership will listen. -Katie Landaal

Integrations, resellers, and the CAC story

Finance cares about four things: CAC, LTV, margin, and time to payback. Partners must be framed in those terms to become a board-level investment. Katie consistently asks three integration questions:

- Is this integration demanded by the ICP?

- Is there a direct monetization path or a measurable path to increased consumption?

- What are the projected unit economics and timeline to ROI?

If an integration cannot be charged for directly, model indirect revenue scenarios: usage expansion, seat growth, or cross-sell acceleration. That projection, with reasonable assumptions, converts a product feature into a growth lever.

How to work with your CFO

The CFO is often your most critical partner. If you can make the partner motion look like a cost-efficient acquisition channel, you win. Build a three-to-five-year plan showing how partner investment reduces overall CAC, shortens sales cycles, and improves margin.

Katie learned from a CFO mentor that you must be explicit about investment timelines. For GSIs, you might need a full year of investment before returns appear. Explain the upfront pain and the long-term payoff. When the CFO can see the hire-to-return multiplier, they become an ally rather than an obstacle.

The CFO can be the most influential — get them to understand the timeline and the payoff. -Katie Landaal

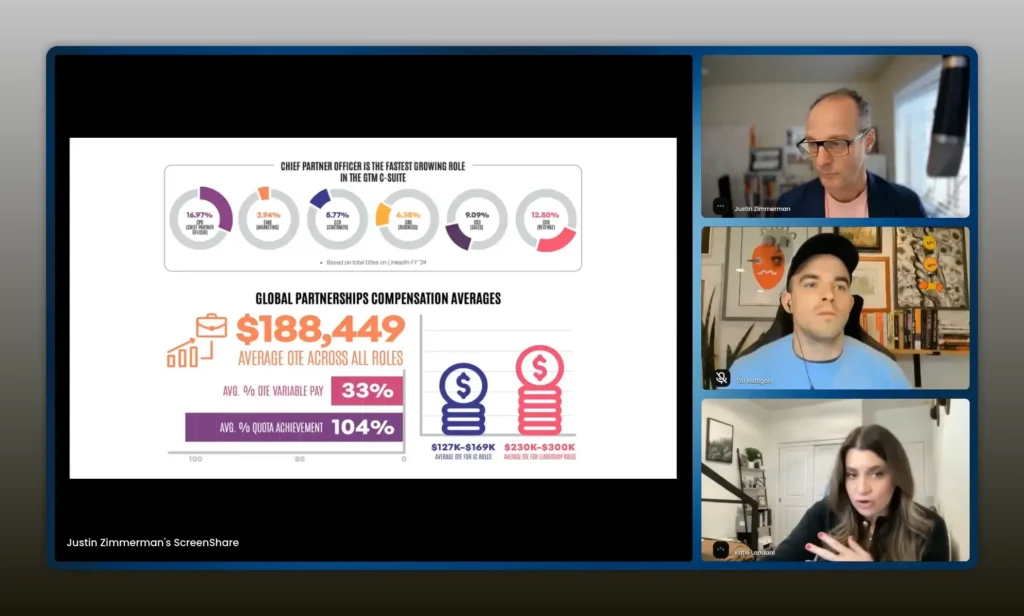

Using the partner compensation calculator and data

You cannot negotiate effectively without good data. Generic compensation databases dilute partnership roles into business development buckets. You need a partnership-specific dataset that maps role, company size, seniority, and comp structure.

Tai’s team aggregated tens of thousands of job listings and user-submitted data to build a partner compensation calculator that produces fair benchmarks. Use that data to:

- Prove market rates to your manager.

- Build a two- to three-tier comp plan tied to measurable milestones.

- Show a career ladder and compensation trajectory for the function so leadership understands the cost of attrition.

If you prefer the script approach, reference comparable leaders at companies of similar size and stage and present that as the target market rate for your role.

Scripts: how to have the compensation conversation

Use language that creates shared ownership. Avoid entitlement framing. Use this simple script as a foundation:

- Present the research: “I’ve spoken to peers at five companies of similar size and stage. Their comp structures look like X.”

- Show your path: “Here are the milestones I can hit in the next 6-12 months that align to that level.”

- Invite partnership: “How can we work together to get me to that market level?”

This approach turns compensation into a business plan rather than a demand. It gives managers a roadmap to justify raises and promotions.

Give your manager an awesome mission — a set of things to work with you on to get you to the next level. -Tai Rattigan

Measuring ROI and telling the revenue story

Measurement is your armor. If you can demonstrate sourced revenue, influenced revenue, CAC delta, and margin improvements attributable to partners, you can make the case for headcount, platform investment, and compensation increases.

Build dashboards that answer:

- How much revenue was sourced through partners this quarter?

- What is the average CAC for partner-sourced deals vs direct deals?

- How many integrations or reseller engagements converted to paid usage and by how much did they expand usage?

- What is the expected ROI over 12, 24, and 36 months for strategic partner investments?

The clearer the business case, the more defensible your compensation request becomes.

Common mistakes to avoid

- Relying on vague titles or non-specific compensation benchmarks.

- Asking for raises without a measurable plan or milestones.

- Spreading effort across too many low-value partners instead of focusing on one high-leverage ecosystem.

- Not modeling the financials for leadership — assumptions without numbers won’t persuade finance teams.

Implementation roadmap

Use this 90-day, 12-month roadmap to shift from reactive to strategic.

- 0-30 days: Collect benchmarking data, identify 3 comparable companies, and prepare your compensation conversation script.

- 30-90 days: Launch one short-term play (referral or affiliate), build basic ROI dashboard, and start CFO conversations about investment timelines.

- 3-12 months: Pilot a reseller or integration program, develop a three-year financial model, and secure executive sponsorship for scale.

- 12 months and beyond: Convert pilots into programmatic engines, hire the team needed to scale, and present a newly justified comp structure tied to demonstrable revenue impact.

Short-term wins sustain you while you build the long-term engine. -Katie Landaal

FAQs

What benchmarks should I use to set my compensation target?

Use role-specific partner compensation data adjusted for company size, stage, geography, and seniority. If you cannot access a partnership-specific dataset, gather comparables from peers at similar companies and present both market-level data and company-specific impact metrics to justify your target.

How do I start the conversation with my manager without it becoming adversarial?

Lead with research and a shared plan. Present comparable compensation, outline the milestones you will hit, and ask your manager to co-design a six- to 12-month roadmap. Framing the discussion as a collaborative mission reduces friction and increases the chance of support.

Which partner plays create the most long-term value?

Strategic GSIs, meaningful reseller networks, and high-impact integrations tend to create the most long-term value. These plays reduce CAC, expand reach, and can create repeatable revenue streams that scale.

How quickly should I expect partner investments to pay off?

Expect short-term plays to show results in weeks to a few months. For GSIs and complex reseller builds, plan for a 12-month investment horizon before meaningful returns. Be transparent about timelines with finance and leadership.

What metrics matter most when making the business case?

CAC delta, sourced revenue, influenced revenue, deal velocity, and margin impact matter most. Show projections over 12, 24, and 36 months with conservative and aggressive scenarios to demonstrate upside and risk.

Where can I find partnership-specific compensation data?

Seek out datasets and calculators that aggregate partner roles specifically. Look for tools that segment by company size, stage, and seniority. When in doubt, compile peer interviews and job listing data to create a defensible benchmark.

Conclusion

Your compensation is a direct function of how well you define value, measure it, and tell the story. Move from vague influence metrics to hard-dollar economics: show how partners lower CAC, increase margin, and generate repeatable sourced revenue. Use benchmarking to set fair market expectations, adopt a collaborative mindset with your manager and CFO, and focus your time on high-leverage plays like GSIs, resellers, and monetizable integrations. Build a roadmap, track impact, and iterate. When you align partner outcomes to company economics, compensation becomes inevitable rather than aspirational.