Recruit 100 Revenue Generating Affiliate & Agency Partners In 30 Days

Featuring expert advice from Ben Jolly, Corey Snyder, and Tyler Calder.

Introduction

You are likely under pressure to grow partner sourced revenue while CAC keeps rising, and affiliate & agency partners are the lever you might be underusing. They provide a big opportunity to reduce acquisition costs, extend reach, and unlock new channels—if you recruit the right partners and activate them properly. The risk is the familiar 90-10 problem: most partner programs generate little revenue because recruitment focuses on quantity over quality, onboarding is manual and slow, and marketing and partnerships operate in silos. This mini-playbook will help you change that.

Only about 10 percent of partners drive meaningful revenue—most teams focus on signing partners, not activating them. -Tyler Calder

Table of Contents

- Why the 90-10 partner problem matters

- Rethinking partner types across the buyer journey

- Affiliate and creator playbook

- Hunting competitors’ partners and building an Ideal Partner Profile (Corey Snyder)

- How tech becomes a force multiplier

- KPIs that prove partnership impact

- Step-by-step recruitment and activation checklist

- Case examples and tactical takeaways

- Common mistakes and how to avoid them

- Practical tools and templates

- FAQs

- Conclusion

Why the 90-10 partner problem matters

When you hear “90-10” in the partner world, it describes a universal pain: roughly 90 percent of your partner base produces only 10 percent of revenue. That imbalance eats budget and executive patience. Acquisition teams are rewarded for signing partners, but sign-ups are not the same as activated, revenue-driving relationships.

The consequence is twofold. First, you waste cycles onboarding and managing partners who never send pipeline. Second, you miss opportunities to scale channels that actually convert. The remedy is a combined approach: recruit partners with a high propensity to generate revenue and set up systems to onboard, enable, and measure them efficiently.

There is so much indirect revenue opportunity across the entire buyer journey. -Tyler Calder

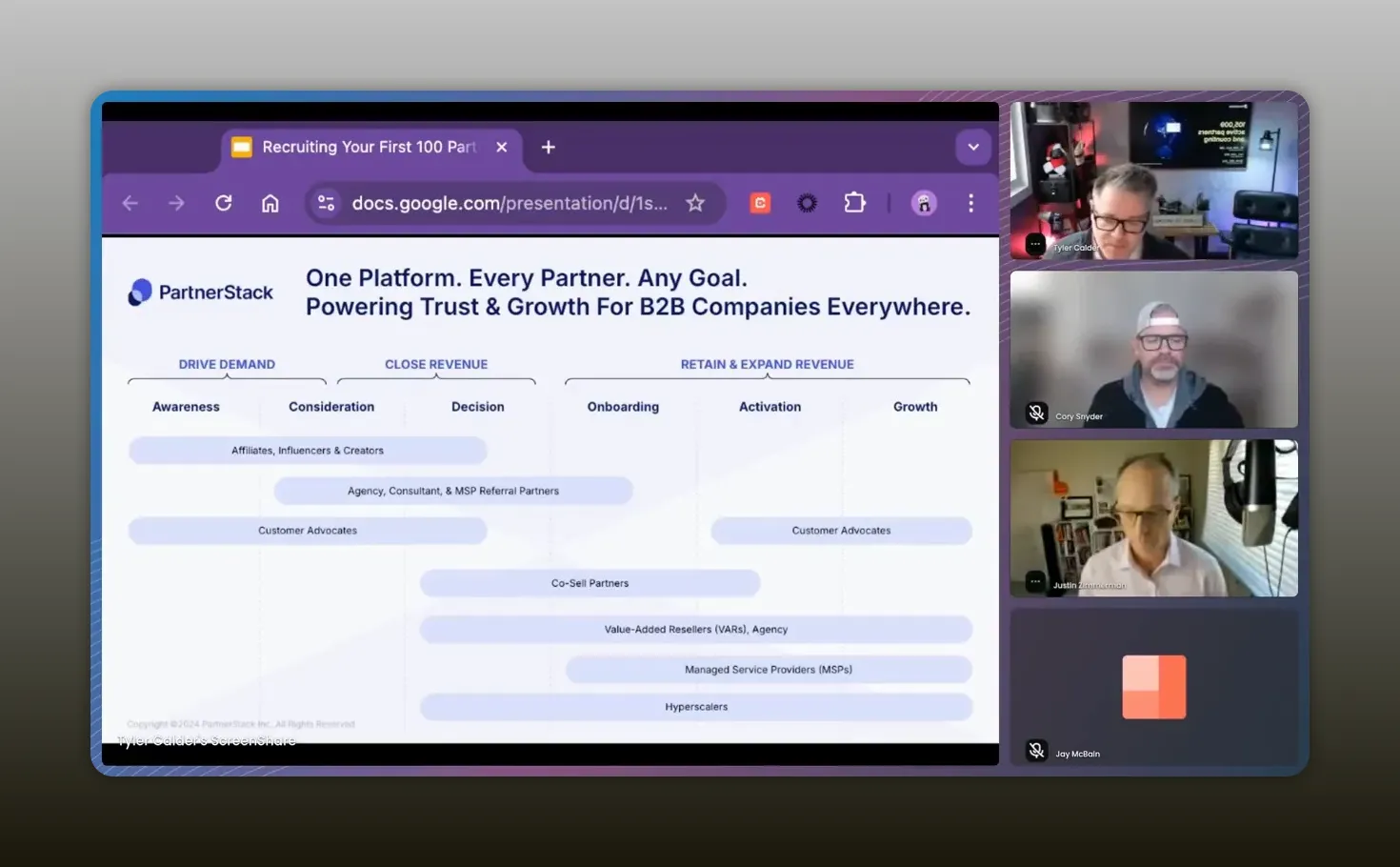

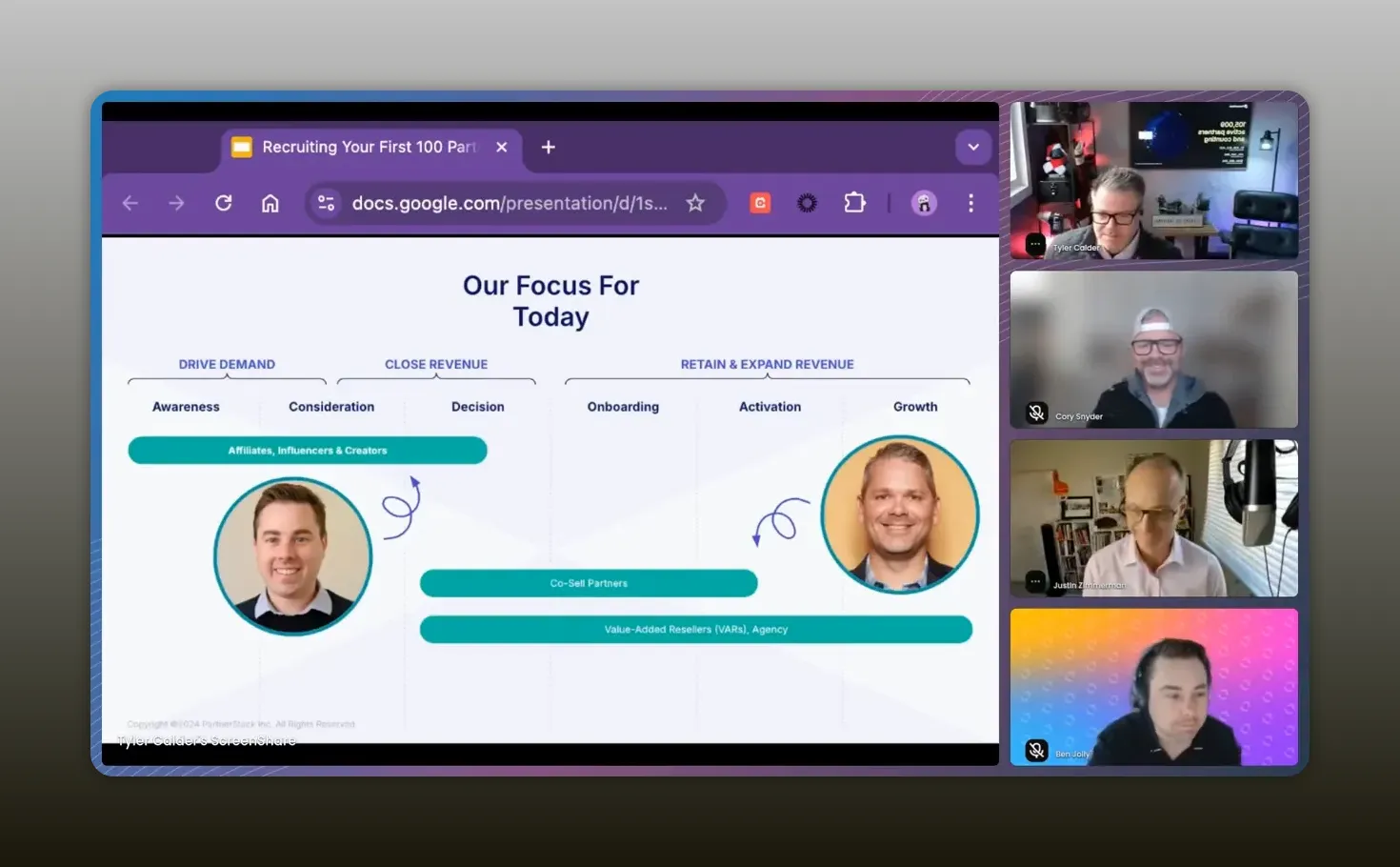

Rethinking partner types across the buyer journey

Traditional partner categories—reseller, referral, affiliate, co-sell—are useful mental models, but they often box partners in. Your best partners will wear multiple hats throughout the buyer journey. A content creator might drive top-of-funnel signups as an affiliate, then support onboarding as an influencer, and later feed into expansions through referral relationships.

Think about partners by the outcome they influence: demand generation, deal acceleration, or expansion. This view helps you align recruitment criteria, enablement, and metrics to business goals rather than rigid labels.

Partners do not want to be boxed in; it’s about how they influence the journey. -Tyler Calder

Affiliate and creator playbook

Why affiliates and creators matter for B2B

Affiliates, influencers, and creators are no longer purely B2C channels. For product-led B2B companies, creators and content sites that rank for “best X software” can be massive sources of free signups. If your product has a freemium or trial model, commission on signups can be a clean, scalable way to seed the top of the funnel.

What to evaluate before onboarding an affiliate

Ben recommends evaluating three core signals:

- Audience fit — Are visitors coming to this site or channel to research software or tools? Look for intent-driven behavior, not just raw traffic.

- Traffic quality — Use tools like Ahrefs to see organic keyword rankings. Ranking for “best project management software” is far more valuable than ranking for viral celebrity keywords.

- Geo and monetization alignment — Where does their traffic come from? If your paid conversions come mostly from the US and UK, heavy traffic from geographies with low conversion value may not be a fit.

Is the audience a fit? Are people coming to that site to find recommendations for software? -Ben Jolly

Commission model considerations

If you are product-led, paying on free signups can be a smart choice because the conversion path from free to paid is long. If you pay only on paid conversions, you may miss out on creators who excel at driving demos or trials. Match your compensation model to the part of the funnel the partner influences.

Red flags to watch for

Not all traffic is equal. A partner may show 28 million sessions in Ahrefs, but if their top keywords are non-relevant viral topics and their traffic has shifted toward geographies you don’t monetize well, decline the partnership. Surface-level metrics can be misleading without deeper inspection.

We dug into their keyword profile and found top-ranking terms that were not relevant. We declined the partnership. -Ben Jolly

How to position affiliate work internally

Ben separates affiliate KPIs from channel/reseller KPIs. His core metric is net new workspace signups. This clarity makes reporting straightforward and sets expectations for what success looks like: bringing new users into the product-led funnel, then letting lifecycle marketing and sales handle the conversion to revenue.

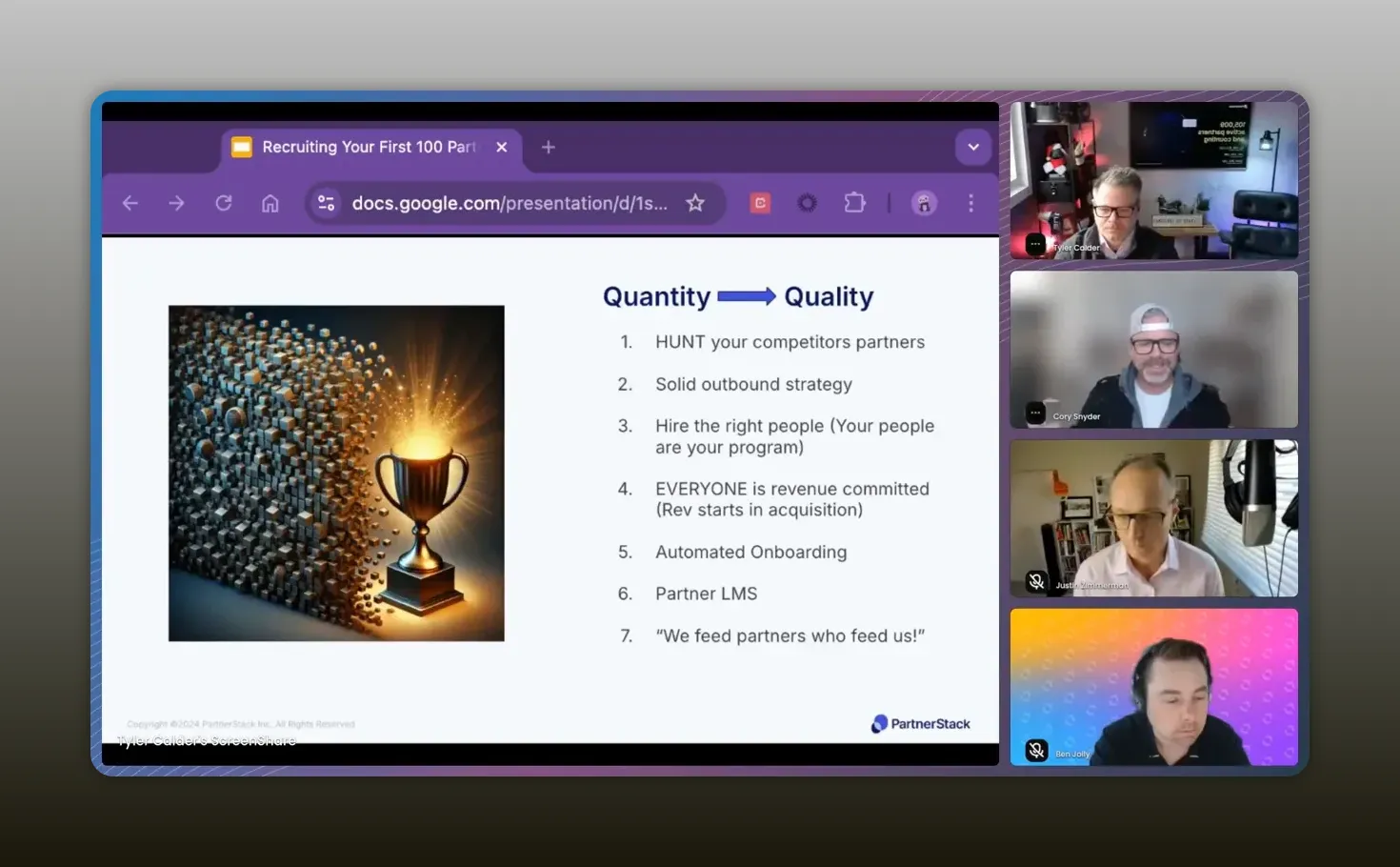

Hunting competitors’ partners and building an Ideal Partner Profile

Why you should hunt competitors’ partners

Corey’s method starts with data. Competitor partners are valuable because they are already productized and experienced in selling solutions like yours. Onboarding them can take 30 to 60 days instead of six months because they have services, processes, and customer examples ready.

This accelerates revenue and gets you the data you need to refine your Ideal Partner Profile (IPP) and partner ICP. The short-term goal: generate revenue quickly. The medium-term goal: collect data to identify the highest-potential partner archetypes.

When you hunt someone’s partners, it takes 30 to 60 days to onboard them because they’ve already done the hard work. -Corey Snyder

How to find competitor partners quickly and cheaply

Corey keeps it deliberately simple:

- Scrape competitor partner directories or marketplaces.

- Enrich the list with contact and firmographic data from tools like ZoomInfo or Apollo.

- Outreach via LinkedIn with a clean message: you want a partnership, not a sale.

He even suggests hiring low-cost talent to scrape lists and then enriching that data. This approach is a high-velocity way to build pipeline and identify partners who can onboard quickly.

What to say when you reach out

Be direct and relational. Corey frames his pitch around diversification and revenue. Tell partners you are asking them to diversify, not replace existing relationships. That honesty builds trust and positions you as a long-term collaborator.

We went from generating 100–150k pipeline to 1.5 million in 10 months by streamlining the process. -Corey Snyder

How tech becomes a force multiplier

Technology is what lets you scale recruiting, onboarding, enablement, and payouts. The gains come from automating manual steps and eliminating bottlenecks so your team can focus on relationship-building and strategy.

Automate onboarding and eliminate blockers

Corey gives a concrete example from Teamwork:

- Eliminate manual contract steps like DocuSign when the platform can manage terms.

- Make application-to-onboarding a single automated flow: vet, send a 25-question application, create sandboxes, and trigger introductions.

- Push partner-registered deals into CRM automatically so your revenue conversation starts during acquisition, not after a sale is logged.

We automated the onboarding flow so by the time I talked to a partner they already had registered deals. -Corey Snyder

Be intentional about what you buy

Buy technology to solve immediate pain points, not a future-state shopping list. Corey suggests using a PRM or partner platform for specific needs:

- Automate payouts and finance reconciliation

- Enable partners to register deals and push them into your CRM

- Support affiliate tracking and commission models if you run marketing-style programs

Do not buy bells and whistles you will not use. Focus on the few automations that remove biggest blockers and scale partner throughput.

KPIs that prove partnership impact

To make the partnership function undeniable to leadership, measure what leadership cares about:

- CAC impact — Partnerships that lower cost per new customer are easy to justify. Benchmarks shared: companies leveraging partnerships are spending about $0.90 to acquire a dollar of revenue versus $1.18 average.

- Pipeline generated — Registered partner deals in CRM that flow to sales.

- Net new signups — Particularly for product-led models, count new accounts or workspaces attributed to partners.

- NRR and expansion — Partners who influence upsells and renewals drive compounding value.

- Time to revenue — How long it takes from partner onboarding to first registered deal or first conversion.

Clear segmentation of partner types and KPIs prevents noise: affiliates should be measured on net new signups; resellers on revenue and retention; co-sell on sales-assist conversions.

Step-by-step recruitment and activation checklist

Use this checklist as a practical playbook to turn recruitment into revenue:

- Define the outcome you need: signups, pipeline, or upsell.

- Build or refine your Ideal Partner Profile (IPP) using data from competitor partners and early wins.

- Source prospects:

- Scrape competitor directories and marketplaces

- Use partner discovery tools or network-success teams if available

- Identify creators ranking for buyer-intent keywords (Ahrefs, Google Search Console)

- Enrich prospect data using ZoomInfo, Apollo, or similar.

- Outreach with a clear offer: diversify revenue, quick onboarding, defined first win.

- Automate onboarding:

- Replace manual contract steps with in-platform terms

- Trigger sandboxes, enablement emails, and toolkit access automatically

- Auto-register deals to CRM on partner inputs

- Enable partners with focused content:

- One-pager value props and price comparisons

- Battlecards for common objections

- Pre-built campaigns creatives for affiliates

- Measure and iterate weekly: CAC, pipeline, signups, conversion rates.

- Double down on the highest-performing partner archetypes and pause or rework low performers.

Case examples and tactical takeaways

Two practical examples crystallize the playbook:

Affiliate example — A content site reaches out claiming 28 million organic sessions. You check Ahrefs and see growth, but the top keywords are non-intent topics. Geo distribution is skewed toward low-monetization regions. The right move: decline the flat-fee request and prioritize partners whose keyword intent and geos align with your revenue model.

Agency marketplace example — You scrape a competitor’s partner directory, enrich it, and run highly targeted LinkedIn outreach. Because these agencies have existing productized services, you onboard them in 30 to 60 days, register deals quickly, and gather data to improve your IPP for long-term recruitment.

Common mistakes and how to avoid them

- Measuring the wrong thing — Counting partner signups as success without tracking downstream revenue or pipeline.

- Buying tech for future needs — Purchasing a full-featured PRM for hypothetical use rather than solving current blockers.

- Ignoring audience intent — Accepting partners with large traffic but no buyer intent.

- Manual onboarding — Letting a slow onboarding process choke partner momentum.

- Not differentiating KPIs by partner type — Expecting affiliates and resellers to hit the same metrics.

Practical tools and templates

Tools you should consider in your stack:

- Partner discovery platforms and networks to source and vet partners at scale

- Ahrefs or similar to audit organic intent and keyword rankings

- ZoomInfo, Apollo, or similar for enrichment

- CRM integration to push partner-registered deals directly into sales workflow

- PRM or partner management platform to automate onboarding, payouts, and tracking

Grab the guide — it’s practical checklists, templates, and guidance to help you recruit and activate revenue‑generating partners fast. -Tyler Calder

FAQs

What types of partners should I prioritize first?

Prioritize partners that align to the outcomes you need now. If you need top-of-funnel, prioritize affiliates and content creators who rank for buyer-intent keywords. If you need revenue quickly, prioritize resellers and agencies already productized for your space. Hunt competitors’ partners to accelerate time to first revenue.

How do you evaluate if an affiliate is a good fit for B2B?

Evaluate audience intent, traffic quality, and geo alignment. Use Ahrefs or similar to check if they rank for research-oriented keywords like “best X software.” Look at geo distribution to ensure traffic aligns with your monetization markets. Decline partners with large but irrelevant traffic or misaligned geos.

What KPIs should affiliates be measured on?

For product-led companies, measure affiliates on net new signups or free trials attributable to them. If you use a rev-share model tied to paid conversions, align compensation and expectations accordingly. Segment KPIs by partner type to avoid conflating expectations.

How can technology reduce time to onboard partners?

Use a partner management platform to automate application intake, sandbox provisioning, partner introductions, deal registrations, and payouts. Remove manual steps such as DocuSign and manual sandbox creation. Automations free onboarding teams to recruit more partners and focus on enablement.

How quickly should I expect partners to generate revenue?

It depends on partner type. Agencies and resellers that are already productized often onboard and produce registered deals in 30 to 60 days. Affiliates and creators may take longer to influence the funnel, especially if you commission on free signups and then rely on lifecycle conversion to paid. Track time to first registered deal and optimize the process to shorten it.

How do I persuade executives to invest in partnerships?

Align partner metrics with executive priorities: show CAC reduction, pipeline growth, and improved ROAS. Use pilot programs with clear KPIs and automation to show how partner-driven acquisition costs less than traditional channels. Benchmarks suggest partnerships can reduce CAC by about 25 percent and increase ROI by about 31 percent when managed end to end.

Conclusion

Partnerships are a strategic growth lever when you think in outcomes, not categories, and when you pair recruitment savvy with automation. Start by hunting partners who can onboard fast, validate them with data, automate onboarding to remove friction, and measure the right KPIs. Align compensation to the part of the funnel your partners influence, and iterate quickly. When marketing and partnerships operate together, you can unlock exponential growth instead of linear gains. Recruit smart, enable relentlessly, and measure everything.